NEST’s exclusion of Cairn from its ethical option follows on from leading investors divesting the company recently and a steady stream of investor interest in the Western Sahara issue more broadly.

The Political Context:

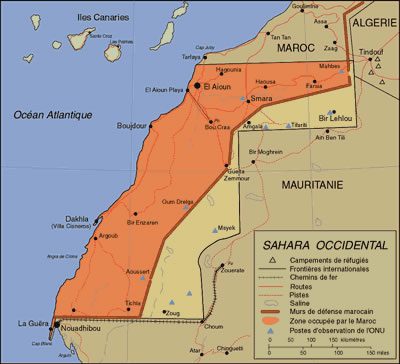

Often referred to as the last colony in Africa, Western Sahara was occupied by Morocco soon after Spain, the former colonial power, withdrew in 1975 on the back of the UN decolonization process.

Before Morocco’s occupation, the International Court of Justice, the UN’s judiciary branch, had not found “legal ties” to support either Morocco’s or Mauritania’s claims — the latter later gave up on its annexation ambitions.

No state has yet recognised Morocco’s sovereignty over Western Sahara after the occupation. The Polisario Front liberation movement proclaimed the Sahrawi Arab Democratic Republic in February 1976, and fought a war for independence until the UN brokered a ceasefire in 1991 based on the premise of holding a referendum of self-determination, which has never taken place.

The population of the refugee camps in neighboring Tindouf, Algeria, is 165,000 according to UN estimates.

More recently, in December 2016, the European Court of Justice decided on an appeal case dealing with Polisario’s claim that Morocco’s trade agreements with the EU should be invalid when it comes to Western Sahara products.

The Court maintained the validity of the trade agreements but it ruled they don’t apply to Western Sahara as it cannot be reputed as part of Morocco.

Then on January 31 this year, EU Climate Action and Energy Commissioner Miguel Arias Cañete answered a Parliamentary question about how to comply with international law while cooperating with Morocco on renewable energy projects which include plants in the Western Sahara.

Cañete said that the Declaration, signed on November 17 last year, for future cooperation on renewable energy with Morocco “will be implemented taking due account of the separate and distinct status of the territory of Western Sahara under international law”.

Tensions between Morocco and the EU have since escalated. On February 6 the Moroccan Ministry of Agriculture and Fisheries issued a statement

recalling the successful trade relationship between the two and warned that eroding it, would pose “a real risk” regarding the “resumption of migration flows” which Morocco has managed to contain.The Investment Context:

None of this has been happening in an investment vacuum. While perhaps not as prominent as the West Bank issue, responsible investors have long had the Western Sahara situation on the radar screen.

It has been regularly covered in RI over the past 10 years. In 2011 we ran a blog by Anna Hyrske (then at Ilmarinen) and Anna Tytti Kaasinen of GES Investment Services with the title ‘Investors should examine their exposure to companies linked to Western Sahara’. They said they “strongly believe that investors have an important role in encouraging their investees to mitigate the related risks and behave in accordance with international laws and norms on one hand, and to meaningfully contribute to improving the situation on the ground on the other”.

In 2011 the Norwegian ministry of Finance excluded US-based FMC Corp. and Canada’s Potash Corp. of Saskatchewan (Potash) from the fund’s investment universe for “serious violations of fundamental ethical norms” stemming from their purchases of phosphate from the troubled Western Sahara. Then in late 2016 they excluded Cairn and Cosmos, with the Ethical Council saying it had “extensive dialogue” with the companies and meetings with the Moroccan authorities and local representatives.

In 2012 GES looked at Siemens over a wind farm project in the disputed region following media reports that it violated the human rights of the Saharawis.

In 2015 Dutch pension investment giant PGGM was among investors who supported a shareholder motion on human rights in the Western Sahara at Potash’s AGM. The resolution had been filed by a group of faith investors and the Meritas Jantzi Social Index Fund and called for an independent, public assessment of Potash’s human rights responsibilities due to its phosphate supply from the region “having regard to the UN Guiding Principles and associated international human rights standards”. The Swedish AP funds exited Agrium (which is currently merging with Potash Corp.) in 2015

With reporting by Daniel Brooksbank.

Source link : https://www.responsible-investor.com/w-sahara-back/

Author :

Publish date : 2017-03-02 08:00:00

Copyright for syndicated content belongs to the linked Source.