Peak Rare Earths (ASX:PEK) has signed a non-binding indicative lenders consortium term sheet to support completing a debt solution for the Ngualla Project in Tanzania, with an aggregate debt of US$176.6 million ($261.47 million).

The term sheet has been signed by several lender consortium participants, including the Industrial Development Corporation of South Africa, Development Bank of Southern Africa, Tanzania’s CRBD Bank and NMB Bank, as well as the East African commercial bank.

Peak Rare Earths, which has a market capitalisation of $49.28 million, adds that the Export Credit Insurance Corporation of South Africa has also confirmed indicative appetite to provide political and commercial risk insurance cover for a South African content-level linked senior debt tranche.

Discussions are ongoing with other prospective financiers.

Under the term sheet, key aspects include a two tranche, senior secured project financial facility with a covered tranche supported by political and commercial risk insurance, as well as an uncovered tranche.

Peak Rare Earths adds the facility has a tenor of up to nine years, including a grace period for construction and ramp up activities, as well as a provision for a cost overrun facility, and market standard debt covenants.

CEO Bardin Davis says this marks an “important” confirmation of the Ngualla Project, and is another milestone as the company progresses towards a final investment decision.

“We are delighted by the strong support from some of Africa’s leading development finance institutions and export credit agencies,” he says.

“It is also particularly pleasing to have strong participation from major Tanzanian and East African-focused banks.”

The company adds that a strategic partnering process focused on introducing a project level investor is continuing.

Further, a cost and optimisation study, targeting an expansion in production and additional reductions in costs and funding requirements, is also underway.

Peak Rare Earths says revised bankable production and cost estimates are anticipated to be finalised ahead of a targeted final investment decision in December 2024.

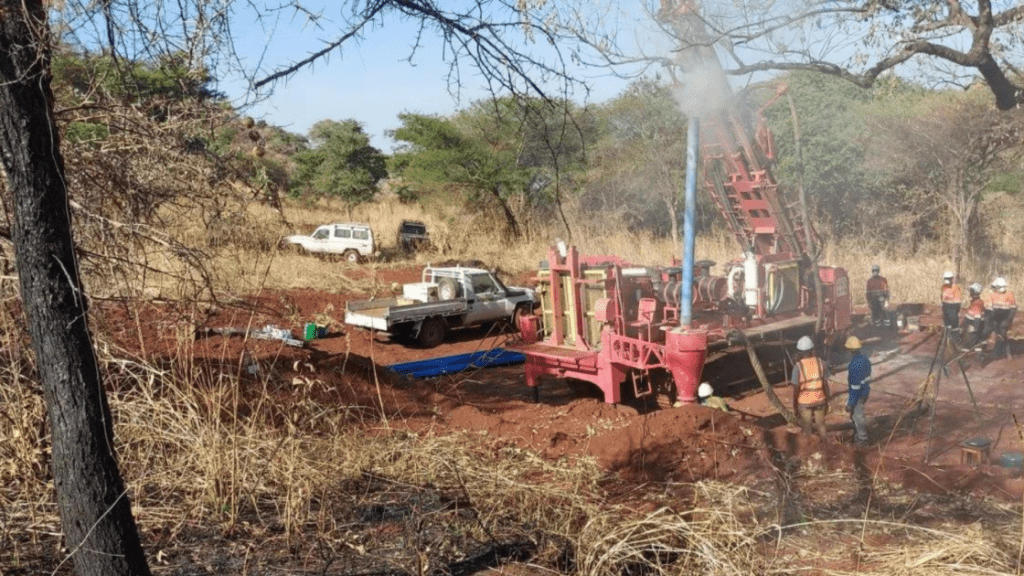

The Ngualla Project is a rare earths development project lies near the Ngwala Village and 150km from Mbeya in the Songwe region.

The Roundup

– Peak Rare Earths signs non-binding indicative lenders consortium term sheet

– Discussions ongoing with other prospective financiers

– CEO Bardin Davis says its an “important” milestone

Write to Aaliyah Rogan at Mining.com.au

Images: Peak Rare Earths

Source link : https://mining.com.au/peak-rare-earths-signs-deal-to-support-261-47-million-debt-for-ngualla/

Author :

Publish date : 2024-07-16 04:57:05

Copyright for syndicated content belongs to the linked Source.