Niger Unlocks $71m Loan from IMF to Boost Economy

Niger government has unlocked access to $71 million loan after the Executive Board of the International Monetary Fund (IMF) completed the fourth and fifth reviews of the country’s Extended Credit Facility Arrangement (ECF), and the First Review Arrangement under the Resilience and Sustainability Facility (RSF).

The decision allows for an immediate disbursement of about US$ 71 million cumulatively under the ECF and the RSF, the Fund said in a statement. IMF added that the two arrangements were extended by six months until December 2025 to ensure sufficient time to implement key reforms and support the authorities’ fiscal consolidation efforts.

The completion of the reviews allows for the immediate disbursement of about US$ 26 million under the ECF—bringing total disbursements under the arrangement to about US$ 210million, in addition to another US$ 45 million under the RSF.

IMF said program implementation was broadly on track at end-June 2023 but was subsequently disrupted by the political crisis, which led to the accumulation of external and domestic debt service arrears.

Several structural benchmarks were not met, including the adoption of an oil-revenue management strategy. The authorities have taken corrective measures to address these deviations. Several reform measures under the RSF were implemented with delay or re-phased to allow implementation.

The authorities have reaffirmed their commitment to the objectives of the ECF and RSF-supported programs—aiming to bolster macroeconomic stability and enhancing resilience to climate change.

After the lifting of sanctions in February 2024, the authorities have resumed full collaboration with WAEMU institutions, despite exiting ECOWAS in late January 2024.

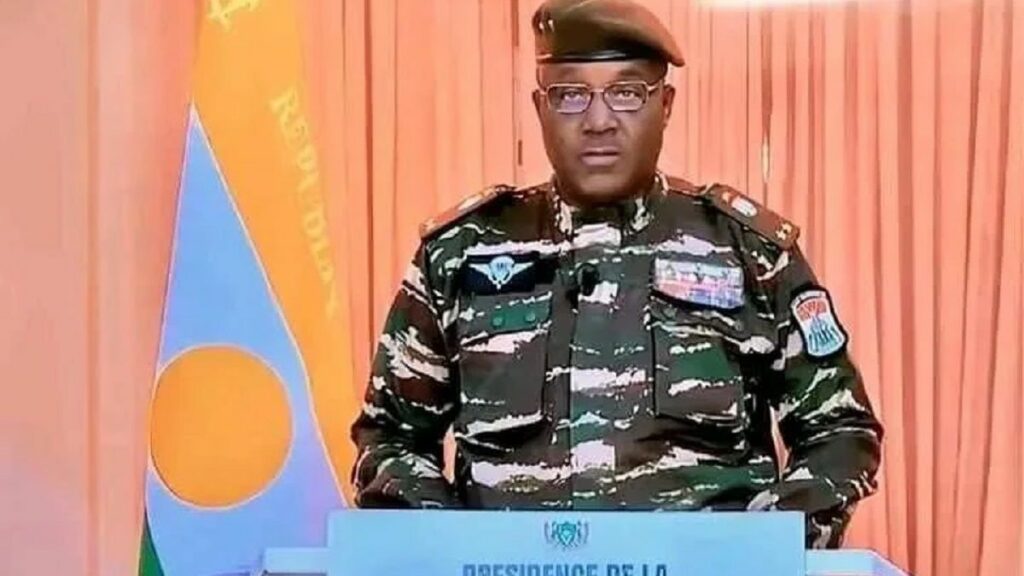

Following the Executive Board’s discussion on Niger, Ms. Antoinette Sayeh, Deputy Managing Director, and Acting Chair of the Board, said, “Niger’s economy has been severely affected by political instability and sanctions following the July 2023 military takeover.

“Nevertheless, the near- and medium-term economic outlooks have improved owing to the start of oil exports, the lifting of sanctions, and increased agricultural production. To contain downside risks, the authorities must rebuild fiscal buffers, improve debt management, enhance social safety nets, and strengthen governance and anti-corruption frameworks.

“Maintaining a strong commitment to program objectives and the agreed fiscal consolidation path amid the difficult context is key.

“Going forward, urgent priorities include adopting an oil revenue management strategy to ensure transparency and insulate fiscal policy against oil price volatility; revising the General Tax Code to broaden the base and increase efficiency.

“…and reestablishing the Supreme Audit Institution to strengthen governance frameworks. The authorities are encouraged to pursue a prudent debt policy, seeking concessional financing, given tighter financing conditions.

“Accelerating domestic revenue mobilization is essential to create fiscal space for priority and development spending. The digitalization of tax and customs administrations and other administrative measures are expected to boost revenues.

“However, the authorities should also pursue efforts to rationalize tax exemptions, broaden the tax base, and increase revenues from the resource sector. Moreover, improving spending quality, particularly in health and education sectors, is key to strengthen the social contract.

“Fostering private sector development, supported by a stable financial system and financial inclusion, is vital for resilient and inclusive growth.

“In addition, advancing the governance agenda is crucial to address the country’s sources of fragility. In that context, the authorities are encouraged to leverage the IMF capacity development support to strengthen fiscal transparency.

“Progress in implementing reforms under the RSF-supported program is welcomed. Stepped up implementation of the measures under the program is essential to build resilience to climate change and lay the foundations to unlock additional finance for climate-related investments.” >>>Nigeria, Angola Inflation Highest in Frontier Markets -Report

The IMF said growth is expected to rebound briskly in 2024 to 10.6 percent due to the start of oil exports and ensuing spillover effects across the economy (notably in the transport sector), as well as increased production in the agricultural sector and the lifting of sanctions.

Source link : https://dmarketforces.com/niger-unlocks-71m-loan-from-imf-to-boost-economy/

Author :

Publish date : 2024-07-17 20:31:08

Copyright for syndicated content belongs to the linked Source.