Ben1183

Alright, let’s face it – South Africa doesn’t have the best reputation at the moment.

Many currently view the largest African economy as corrupt, dangerous, and in a state of perpetual collapse, which are hardly the building blocks of profitable long-term investment.

Alarmist headlines and articles about problems with the power grid, government corruption, and resource mismanagement have plagued the country’s international reputation, and things don’t appear to be getting better in a hurry.

However, over the last 8 months or so, we’ve taken a number of trips to South Africa visiting friends and family that reside in the country.

In that time, our opinion of SA has changed significantly as we’ve gotten to know the land, people, and country as a whole.

Following our visits, the issues with the country are obvious, but we’ve also become more aware of upsides that exist that we hadn’t considered prior. South Africa’s demographics are excellent, the country is resource rich (which should bolster the currency over the long term), and there’s a tangible sense of optimism in the populace that you don’t find in many other places today.

Plus, if you have resources, the lifestyle can rival any other top global destination:

Enes Yilmazer | YouTube

If government services are improved, we think the country could see a massive upswing in foreign direct investment, improved market efficiency, and significantly positive net migration, which should materially strengthen the country’s investability.

Right now, you can get in for cheap.

Today, we’re going to examine South Africa from the bottom up, explaining why we think the country could be the ultimate ‘buy low’ opportunity. Plus, we’ll touch on why we think NYSEARCA:EZA, the iShares MSCI South Africa ETF, is the best way to play the opportunity.

Sound good? Let’s dive in.

South Africa’s Advantages

Let’s start by taking a look at the country’s fundamentals.

As any economist will tell you, the core building blocks to a prosperous economy are the following: Land, Labor, Capital, and Entrepreneurialism.

In our view, South Africa is blessed with all four of these advantages, which makes it a relative standout on the global stage.

First, Land.

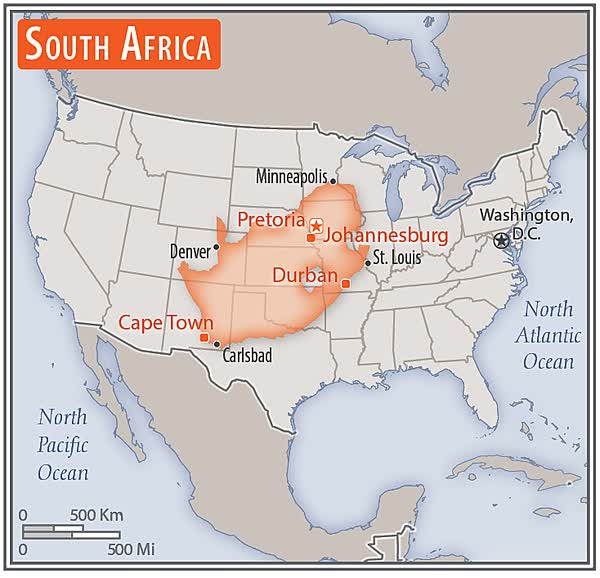

From a geography POV, South Africa is just less than twice the size of Texas, which makes it the 26th largest country on the planet:

CIA Factbook

The country has significant arable land, enough to feed itself and be a net food exporter.

Additionally, the nation is home to considerable mineral wealth, with significant reserves of gold, chromium, antimony, coal, iron ore, manganese, nickel, phosphates, tin, rare earth elements, uranium, gem diamonds, platinum, copper, vanadium, salt, and natural gas.

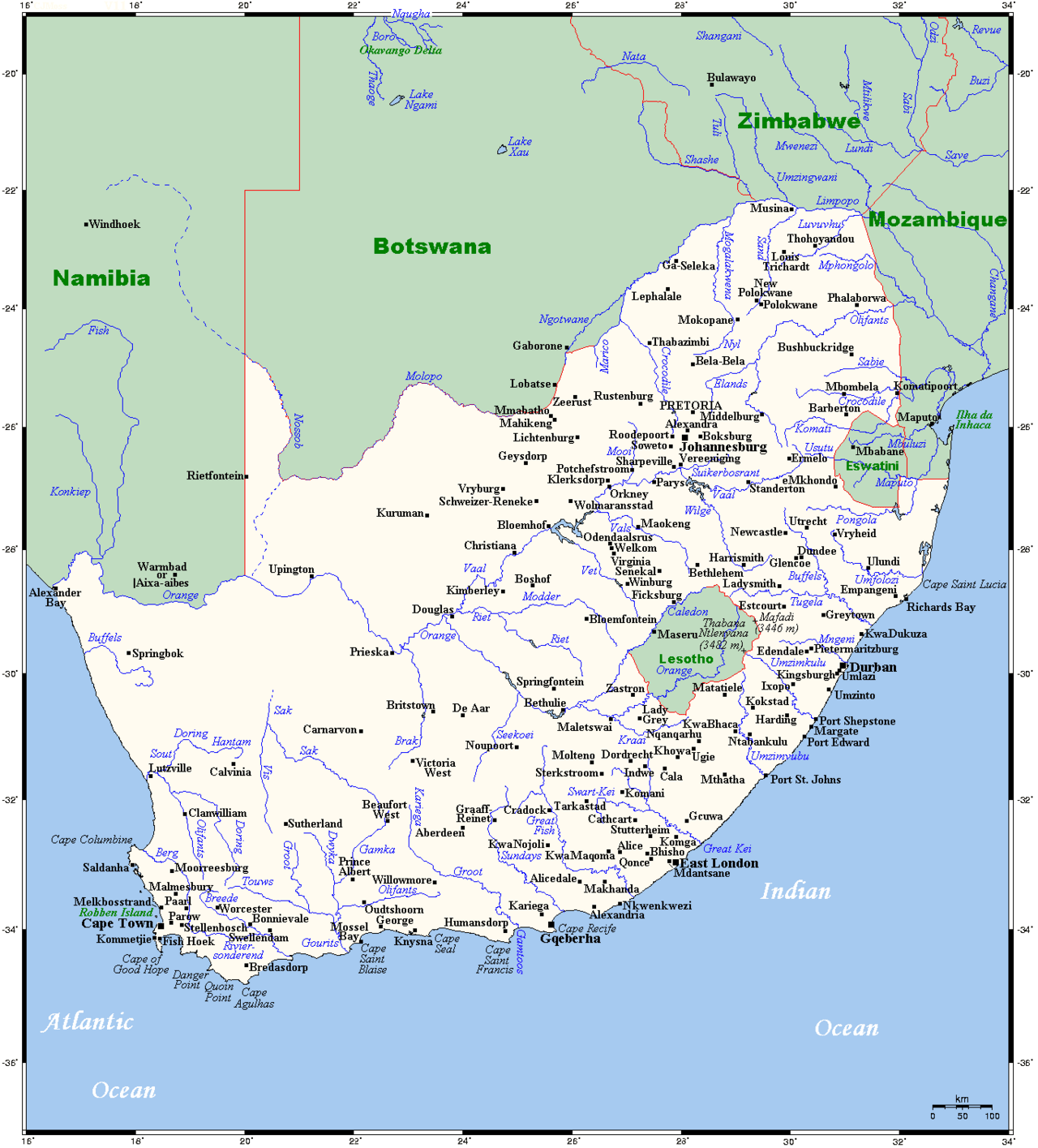

Finally, with a number of natural waterways that can be used for transportation, the country has well rounded geographical profile that can support an advanced economy:

Wikimedia

Second, Labor.

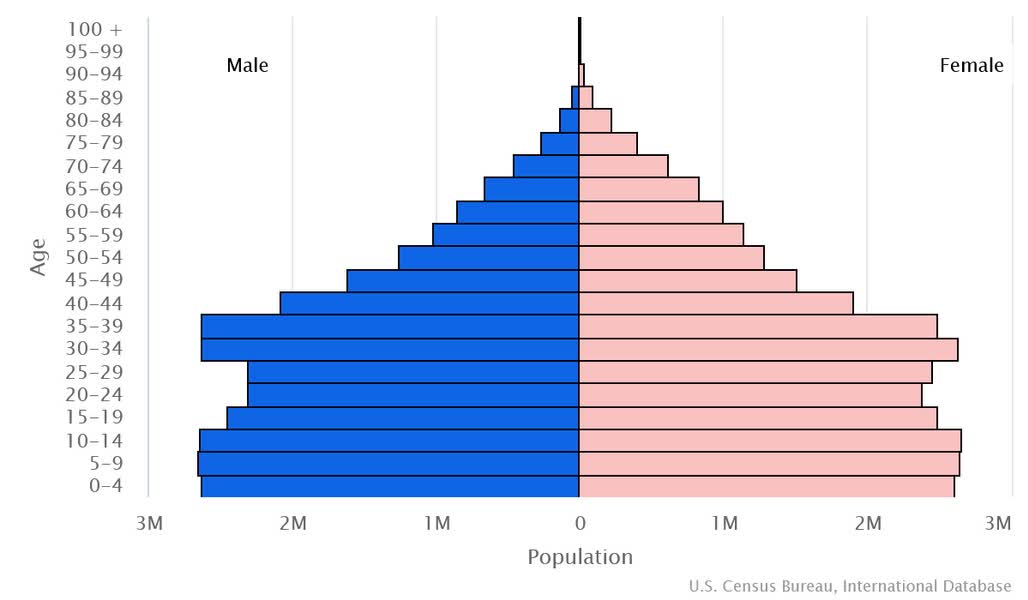

Demographically, most countries would kill for South Africa’s setup.

The population of SA is ~61 million, which makes it the 25th largest country by population in the world.

Here’s the key, though – its fertility rate is 2.27, which is significantly higher than almost all other developed economies globally. At this rate, SA is projected to continue growing into the end of this century, which can’t be said for other countries like the US, UK, Europe, Japan, or Korea.

This high fertility rate has also led to a relatively fat population pyramid, which means that the country doesn’t see much risk in the way of demographic collapse, which is a huge cause for concern for places like China:

CIA Factbook

The population is also highly literate, with more than 95% of the country able to read and write at some level, which is on par with other developing economies like Thailand and Mexico.

While higher education could be improved somewhat, there’s significant demographic tailwinds for South Africa in terms of Labor.

Third, Capital.

Capital can be a bit difficult to suss out when viewing a country at this level, but we’ll look at it from two different angles – GDP per capita, and the country’s physical asset footprint.

In terms of GDP per capita, South Africa ranks poorly on a global scale, but among the best out of the African continent as a whole. Globally, the average ranks quite poorly due to the large population and the concentration of productive assets in the hands of a few, which has caused the average to remain low.

However, structurally, South Africa’s colonial past means that it punches above its weight when it comes to energy, communications, and transportation infrastructure, which are key inputs to economic output over time. SA comes in 21st in installed electricity generation capacity, 18th in cellular infrastructure, and 8th and 11th, respectively, in total railway and roadway footprint.

This is quite impressive, and while GDP per capita remains low, the existing physical infrastructure should support a strong economy over time.

Finally, Entrepreneurialism.

If anything, this is where SA is currently lacking. While there are a number of programs that have attempted to bolster economic dynamism and risk taking (and there are some green shoots here), the sad state of government affairs appears to be stifling overall entrepreneurial activity:

Total Entrepreneurial Activity (TEA), consisting of active businesses less than 3 months old and new businesses up to 3.5 years old, declined from a pandemic high of 17.5% to 8.5% in 2022/23, below the 2019 level of 11%.

Established business ownership (more than 3.5 years) almost halved, from 3.5% in 2019 to 1.8% in 2022/23, after an encouraging peak of 5.2% in the pandemic years.

Much of this decline can be chalked up to the Covid impact, but a lack of effective public services hasn’t helped things.

Overall, though, despite some negatives around the country’s level of entrepreneurialism, if you add up South Africa’s advantages, we think the company has a lot of potential from a long-term view.

South Africa’s Problems

That said, there’s a lot wrong with the country too – primarily stemming from ineffective governance and a lack of decisive leadership.

Many of SA’s problems come from the government layer, as administration after administration has proven incapable of delivering effective public services.

While installed electricity generation capacity is high, effective use of that capacity is low, as load shedding and internal graft have stripped the state-run power utility monopoly, Eskom, of its ability to deliver power reliably across the country.

Poor resource management, especially when it comes to water, has also driven the country to the brink more than once.

Finally, SA is one of the most dangerous countries in the world, which is largely due to an extremely high level of corruption and ineffectiveness within the country’s police service (SAPS). Wealthy neighborhoods don’t rely on cops anymore – they rely on private security.

At a certain point, no matter how well ‘set up’ a country is to prosper, if society is incapable of setting itself up in a way to succeed, then you’ll see pessimism on the part of the markets, which is largely what has happened.

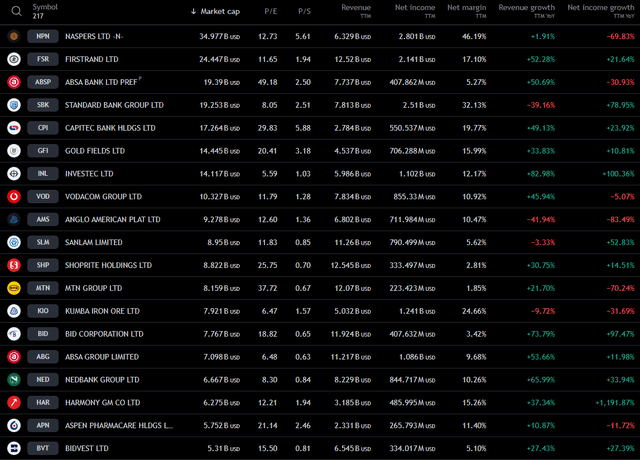

Earnings multiples for local companies – even solid, profitable companies – have been driven well into the teens and lower, despite solid margins and growth over the last twelve months:

TradingView

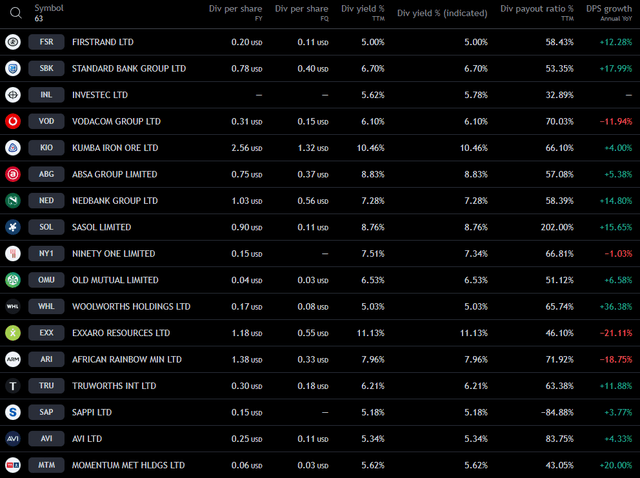

You can also see this in the dividend yields of many of these top companies, which are both generous and well supported:

TradingView

Overall, South Africa has a lot of problems, but if things get better, then multiples should re-expand, and buying into these cash flowing companies now could be a very attractive long-term investment.

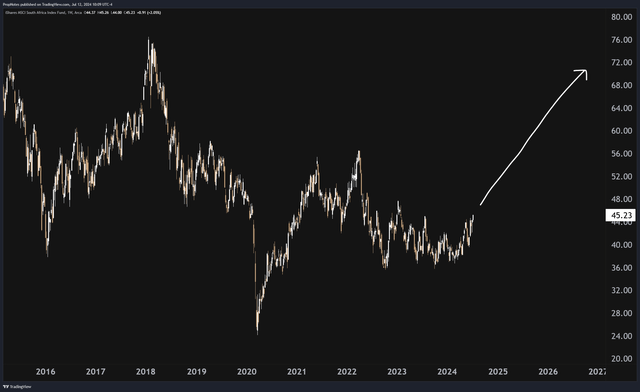

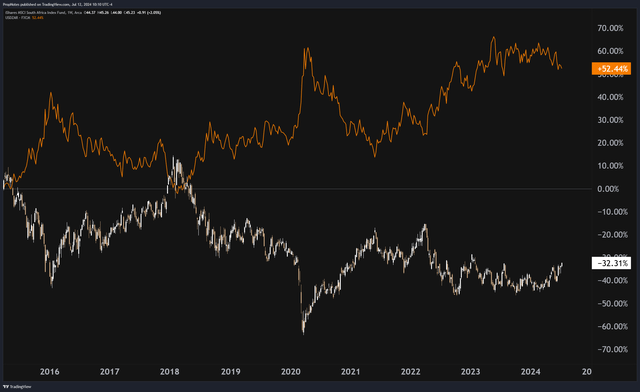

If corruption levels decrease, the ease of doing business increases, and crime drops as a result of improved governance, we think that South African equities as a whole could climb back to historical highs that were reached over the last decade:

TradingView

This represents upside of 60-80% by 2030 (which should be enough time to see further improvements with SA), which isn’t a shabby return given the potential headwinds we’ll see in western markets over that period.

Can The Problems Be Solved?

We see the majority of problems in South Africa stemming from poor overall governance, which the populace has recently showed signs of trying to improve.

In the most recent election, the ruling ANC party, which has been in power for ~30 years, finally faced rebuke, earning less than a simple majority of votes in the South African legislature.

This election result, to us, is a sign that the country has begun to acknowledge problems with the top political party and search for alternatives.

In other words, this is a very good sign.

In most developed markets, national politics has a relatively small impact on equity returns, but in a less developed country like South Africa, reliable public services and rule of law shouldn’t be taken for granted.

Thus, this political development is seen by us as a huge ‘step in the right direction’ to make the country more investible.

Thankfully, stocks are still cheap, as there is a great deal of overall market pessimism that the country will improve in the short term. However, for us, we’re on the optimistic side of things, and expect that the environment will improve substantially in the coming decade. This positivity comes from the aforementioned fundamental tailwinds, a potential ‘changing of the guard’ in government, and the general optimism you’ll see from citizens on the street.

There’s no question that things could be better now, but we expect that the country will continue to improve slowly over time. We’d like to be a part of that re-rating.

EZA As An Investment Vehicle

Investing directly into South Africa isn’t easy (unless you have a broker like Interactive Brokers (IBKR) that gives you access to global equities), and so EZA seems like the most suitable instrument to capitalize on what’s been discussed so far.

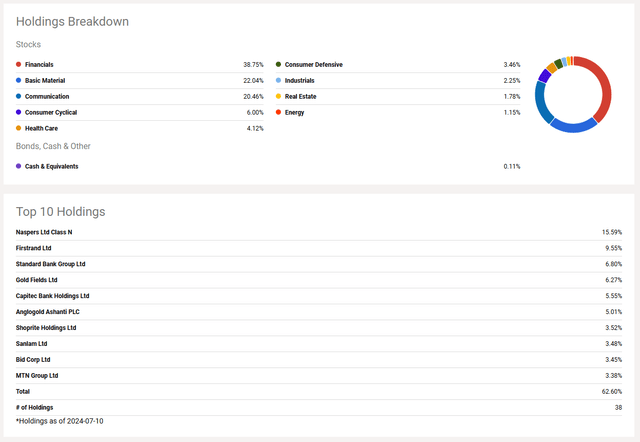

The fund’s top holdings are focused primarily on Financials, Telcos and Miners, which provides a defensive, stable bent to the fund overall allocation:

Seeking Alpha

There’s also a uniquely outsized position in Naspers (OTCPK:NPSNY), a global consumer software company focused on EdTech, Fintech, Classifieds, and Delivery services.

This large cap stock is a welcome addition to the otherwise lower-growth large cap equities in the fund and should balance the diversity of EZA’s aggressiveness overall.

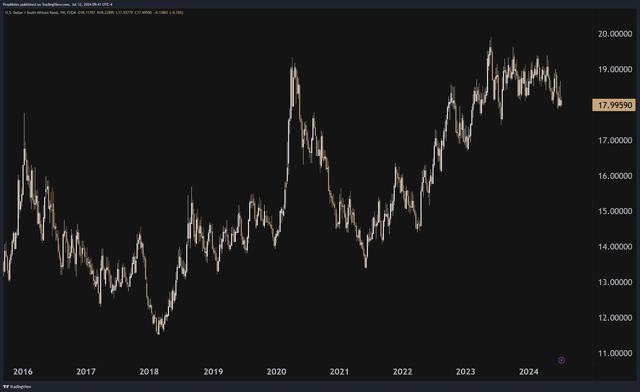

A quick note about currency risk, as many African-focused ETFs face some headwinds in this area – right now, we expect that the South African Rand (ZAR) should remain somewhat rangebound between 12.5 and 19 to the dollar, which is where the pair has traded for the last decade:

TradingView

It’s true that over the long run the Rand has mostly lost ground vs. USD, but given SA’s gold-heavy export market, we think that ZAR should see a relatively high level of stability going forward, especially as concerns around USD and the U.S. national debt mount.

This is key, given how strong the currency’s impact is on EZA’s returns on the whole:

TradingView

SA’s monetary system is conservatively run and hasn’t faced runaway inflation or other issues as a result of strong commodity exports, and the underperformance up to now is because the country has simply fallen behind the USA from an economic perspective.

This isn’t to say that there aren’t risks here, but we think they’re muted, relative to the potential return in the equity market.

Summary

Overall, South Africa has a lot of problems today, and the equity market in the country is very cheap as a result.

However, as the political winds shift and the country begins to vote out the ANC, which has struggled to effectively govern the country, we believe that more of South Africa’s fundamental strengths should shine through.

If the economic situation improves organically, or foreigners begin to see the country’s potential, we could see SA equities increasing substantially in price, in USD, from here, potentially to the tune of 60-80% by 2030.

Thus, our ‘Strong Buy’ rating.

Stay safe out there!

Source link : https://seekingalpha.com/article/4703854-the-investment-case-for-south-africa-eza-is-the-ultimate-buy-low-opportunity

Author :

Publish date : 2024-07-13 08:16:09

Copyright for syndicated content belongs to the linked Source.