Africa’s auto sector

With a large overall market, and several well developed manufacturing centres including South Africa, Morocco and Egypt, Africa’s automotive profile is on the rise.

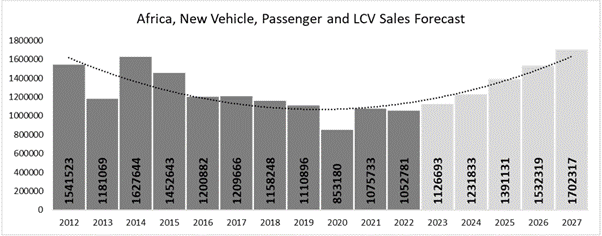

According to the African Association of Automotive Manufacturers (AAAM), in 2022 the market for new cars and light commercial vehicles in Africa was just over one million vehicles. This is a small number compared to developed markets, but does not reflect the size of the overall auto sector in the continent, due to the large number of used vehicle imports. AAAM predict the new market will grow by 61% to reach 1.7m units by 2027.

African Association of Automotive Manufacturers

Ghana is looking to develop its manufacturing capability and sees automotive as a key sector. There have been a number of developments since the inauguration of an automotive policy in 2019 so SMMT visited in January 2024, to understand the sector and explore if there are opportunities for UK firms. The visit was part of a UK government programme called Ghana JET. The JET programme aims to help Ghana develop its automotive industry and also provide commercial opportunities for UK firms. Situated on the coast of West Africa, Ghana has a population of 34 million and GDP per capita of $2,329 USD – placing it just ahead of Cambodia and a little behind India. It has been a stable democracy for many years.

Ghana’s automotive sector

According to Ghana JET, the country’s automotive sector is worth $4bn with 15% CAGR. There are 3.2m vehicles on the road (2022, Ghana Ministry of Transport). According to Ghana’s DVLA, the annual car market is around 100,000, of which 90% are imported used vehicles.

Under its new automotive policy initiated in 2019, the Ghanaian government is seeking to develop the countries’ automotive sector, in order to attract investors and develop local supply chains.

The policy includes tax incentives for investors, restrictions on used imports to boost the new market and the establishment of supporting policies, regulation and institutions, to build capacity and help develop a sustainable and competitive automotive sector.

Key players

Since initiating the automotive policy in 2019, several Semi Knocked Down (SKD) assembly plants have been established locally, producing vehicles for vehicle manufacturers including Honda, Hyundai, Isuzu, Kia, Nissan, Peugeot, Suzuki, Toyota, Volkswagen and Vinfast . The total announced capacity is around 80,000 units per annum, with some 5,000 currently utilised. SMMT visited facilities run by Japan Motors (assembling the Nissan Navarra and Peugeot 3008) and Rana Motors (assembling a Kia SUV and pickup and Ashok Leyland pickup). Both companies were optimistic about future opportunities in Ghana and the region, being ready to invest more and expand production in line with market growth.

Institutions and standards

Under the new automotive policy, the government is taking steps to improve standards and over time, bring in restrictions on the imports of used vehicles and used parts.

The Ghana Auto Development Centre has been established – brings together a number of bodies under one roof including the Ghana Standards Authority, DVLA and Spare Parts Association.

The government is also developing policies and standards to grow the local electric vehicle (EV) market, with plans to introduce EV buses to the capital Accra. Meanwhile Ghana has lithium deposits, though there is currently no local processing capacity.

There are also initiatives to develop automotive skills, with the Ghana Auto Development Centre planning a national automotive training academy. Companies including Bosch and Toyota have their own training centres in Accra.

Opportunities – supply chain

Currently local vehicle assembly volumes are small, with all components coming in as part of SKD kits. So, at the moment, there are no local supply chain opportunities. But as volumes grow over time, the government wishes to transition Ghana from SKD to Completely Knocked Down (CKD) assembly operations, which would offer opportunities for suppliers.

Opportunities – aftermarket

The vehicle market in Ghana is 1:10 new-used, including grey imports. Regulations state that cars older than 10 years cannot be imported, but this is not strictly enforced. As such Ghana has a large population of older used vehicles requiring frequent maintenance and spare parts. During our visit, we noticed that Japanese and Korean cars appear to be the most popular, with European brands also imported. Vehicles in Ghana are left hand drive.

The aftermarket appears to be very informal, with many small businesses at the side of the road, though there are some local distributors. Reliable data on volumes and vehicle types is hard to come by, however Ghana’s vehicle registration body is developing a digital registration system.

Research conducted by Ghana JET has identified the following components where there is strong local demand, but no local manufacturing: lead acid batteries, filters, suspension, brakes, starters/alternator, windscreen glass, wheels/tyres and exhausts.

So far Ghana JET has completed detailed studies on the local market for lead acid batteries, suspension components and filters.

These components have been identified as target areas for local manufacture, in order to develop Ghana’s local supply chain. They may also offer opportunities for aftermarket providers.

Support and next steps

During our visit, SMMT found a warm welcome, with local companies enthusiastic about growth opportunities, with the government and institutions keen to see UK firms doing business in Ghana.

UK firms looking to explore the automotive sector in Ghana are recommended to contact the British High Commission and Ghana JET programme, who have a wealth of information and local contacts, and stand ready to assist UK firms.

SMMT is happy to speak to companies to share our impressions of the market and to make introductions.

Source link : https://www.smmt.co.uk/2024/03/strengthening-the-uk-and-ghana-partnership/

Author :

Publish date : 2024-03-01 08:00:00

Copyright for syndicated content belongs to the linked Source.