In April 2024, the Central Bank of Nigeria (CBN) announced an upward review of the minimum capital requirement for Nigerian banks to strengthen their capacity, enhance resilience, solvency, and continue to support the Nigerian economy. The upward revision was contained in the released Recapitalisation Circular of March 28, 2024, to ensure that the banks have the capacity to take on bigger risks and stay afloat of domestic and external shocks. The announcement, which followed the wake of achieving a US$1 trillion economic destination by 2030, hinged on the fact that the nation needs to address the capital adequacy of its banks, which will provide the fuel for the journey. This is essential to boost the capacities of the Nigerian financial system, which have been significantly impacted by macroeconomic headwinds such as high inflation rates and interest rates, forex illiquidity, and currency volatility in the last two years.

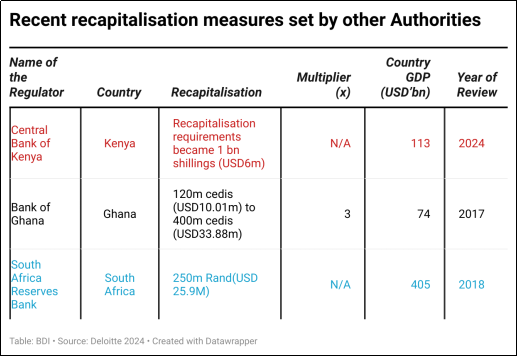

The CBN is not alone in its bid to build the financial resilience and stability of banks. Regulatory bodies across Africa’s leading economies are actively implementing similar reforms. As Nigeria embarks on a significant banking recapitalisation exercise in 2026, it’s valuable to reflect on similar efforts undertaken by South Africa, Ghana, and Kenya. These countries have navigated their own banking sector challenges, offering valuable lessons and insights that can inform Nigeria’s approach.

“This is essential to boost the capacities of the Nigerian financial system, which have been significantly impacted by macroeconomic headwinds such as high inflation rates and interest rates, forex illiquidity, and currency volatility in the last two years.”

Banking reforms in Nigeria

Nigeria’s banking sector has a long history of recapitalisation efforts. Over the past seven decades, the Central Bank of Nigeria has conducted ten recapitalisation exercises, with the most recent one occurring in 2004. This initiative was particularly significant in addressing the fallout from the banking crisis of the 1990s.

Source: Deloitte TTL, 2024

The 2004 recapitalisation was driven by the need to enhance the effectiveness of the banking system and support the broader Nigerian economy. The CBN’s investigations, based on the CAMELS parameters (capital adequacy, management capabilities, earnings sufficiency, liquidity position, and sensitivity to market risk), revealed significant declines in bank performance, necessitating urgent reforms. The consolidation effort aimed to create stronger banks that could better serve the financial needs of the country. It involved raising the minimum capital base from ₦2 billion to ₦25 billion, which led to the consolidation of the sector. The number of deposit money banks was reduced from 89 to 24, creating a more stable and efficient banking system. At the time, ₦25 billion was equivalent to approximately $187 million. Today, due to currency devaluation, that same amount is worth around $20 million, highlighting the financial challenges faced over time.

It is against this background that the Central Bank of Nigeria (CBN) announced a major increase in the minimum capital requirements for Nigerian banks. This move is part of a broader strategy to make the banking sector more resilient and capable of supporting the nation’s economic growth ambitions.

Depending on their type of banking licence, Nigerian banks will need to raise between ₦50 billion and ₦500 billion by March 31, 2026. The CBN estimates that approximately ₦4.14 trillion will be raised through this recapitalisation exercise.

Read also: BDCs struggle with CBN’s recapitalisation rules amidst economic uncertainty

Insights from other sub-Saharan African countries

South Africa

South Africa has a rich banking history, dating back to 1793, when Lombard Bank opened in Cape Town. The South African Reserve Bank (SARB), established in 1920, became the country’s central bank, ensuring financial stability and growth. By 2019, four major banks—Standard Bank Group, ABSA Group, FirstRand Bank, and Nedbank—controlled over 80 percent of the industry’s assets, making them the largest banks in Africa.

South Africa’s banking sector has undergone several recapitalization efforts, notably in the aftermath of the global financial crisis. In 2008, the SARB embarked on significant reforms through the recapitalization effort aimed at enhancing stability and competitiveness. The country adopted Basel III guidelines, which led to an increase in the minimum capital requirement to ZAR 250 million ($25.9 million). As of June 2018, South Africa’s banking sector had assets worth ZAR5,295bn ($400.11 billion) and a return on assets (ROA) of 1.35 percent.

Some of the key takeaways from the latest recapitalisation exercise for South Africa are:

First, South Africa’s banking sector benefited from robust regulatory frameworks that enforced stringent capital requirements and promoted transparency. The South African Reserve Bank (SARB) played a crucial role in monitoring and ensuring compliance. By 2022, the combined tier 1 capital of South Africa’s banking sector exceeded $42.2 billion. The top four banks—Standard Bank, ABSA, FirstRand, and Nedbank—were among the ten largest banks in Africa in terms of asset value. Together, these banks held about 90 percent of South Africa’s banking assets and over 93 percent of the value of deposits.

Second, the recapitalisation efforts boosted market confidence. By ensuring banks had sufficient capital buffers, South Africa managed to attract foreign investment and maintain financial stability. The leading banks have also shown remarkable profitability. In 2022, Standard Bank Group generated more than $2.3 billion in profit, making it the most profitable bank in South Africa. FirstRand followed closely with a profit of over $1.57 billion and had the highest return on equity (ROE) at 20.6 percent. ABSA, with the lowest cost-to-income ratio among the top banks at 51.5 percent, demonstrated efficient operations and strong profitability.

Lastly, the exercise allowed SA banks to leverage technology to enhance banking operations and regulatory oversight. This integration facilitated better risk management and operational efficiency. South Africa’s banking industry is not only the largest on the continent but also one of the most advanced. The country has seen a significant shift towards digital banking, with a growing number of customers using online banking services. By 2023, nearly 86 percent of adults in South Africa would have a bank account, compared to about 64 percent in 2014. The increase in online banking usage reflects the sector’s adaptation to technological advancements, aiming for greater financial inclusion and convenience for customers.

Ghana

Ghana’s banking sector has a rich history of reform and evolution. From the establishment of the Standard Chartered Bank in 1896 to pivotal regulatory changes in the 1970s, Ghana has continuously worked to stabilise and grow its banking industry. The 1970 Banking Act set minimum capital requirements, aiming to bolster the sector amidst various challenges.

The recent banking clean-up in Ghana began in 2017, and this has been particularly impactful. The formal announcement for recapitalization was issued on September 11, 2017, communicating the increase in minimum capital from GHC 120 million to GH₵400 million (US$25.9 million), driving consolidation and growth. The Bank of Ghana, the country’s central bank, initiated and implemented the process of increasing the minimum capital requirements for banks. This exercise was part of a broader financial sector reform plan aimed at developing, strengthening, and modernising the financial sector to align with the government’s economic vision and transformational agenda. An industry-wide Asset Quality Review (AQR) preceded the recapitalisation to ensure the robustness of the reforms.

As a first step, the Bank of Ghana revoked the licences of two insolvent banks to prevent potential spillover effects on the financial sector and to lay the groundwork for further reforms. Concurrently, the Bank of Ghana worked with identified banks to establish a roadmap for recapitalisation in accordance with the capital restoration plans outlined by the Bank and Specialised Deposit Institutions Act, 2016 (Act 930). These measures have led to remarkable financial performance.

The Ghana episode also offers some important insights, such as:

Government Intervention: The Ghanaian government played an active role, providing financial support and establishing the Ghana Amalgamated Trust to aid banks in meeting new capital requirements.

Addressing Non-Performing Loans (NPLs): A significant focus was placed on reducing NPLs, which involved restructuring and writing off bad loans. This approach helped to clean up balance sheets and improve asset quality.

Strengthening Governance: Ghana enforced stricter corporate governance standards to ensure better management practices and accountability within banks.

In 2023, Ghanaian banks saw a 224.6 percent increase in profits, bouncing back from significant losses in 2022 due to the Domestic Debt Exchange Programme. The Bank of Ghana attributes this recovery to improved performance across key income streams, including a 41.5 percent growth in net interest income and a 22.7 percent increase in fees and commissions.

Kenya

Kenya’s recent bank recapitalisation exercise, spearheaded by the Central Bank of Kenya (CBK), has provided several critical insights into the process and impact of increasing capital requirements for financial institutions. This move aimed to bolster the stability, efficiency, and resilience of the banking sector amid an evolving economic landscape.

The most recent bank recapitalisation exercise in Kenya was announced by the Central Bank of Kenya (CBK) in 2015. The CBK proposed to increase the minimum core capital requirement for commercial banks from KES 1 billion to KES 5 billion, to be achieved progressively over a period of four years. The implementation timeline was as follows:

In 2018, banks were required to increase their core capital to KES 2 billion.

2019: The core capital requirement was to be increased to KES 3.5 billion.

2020: The final target of KES 5 billion was to be met.

The Central Bank of Kenya has consistently raised the minimum core capital requirement for banks, reaching KES 5 billion (US$50 million) by 2019. This move aimed to ensure financial stability and support economic growth. The sector remains competitive, with significant growth in both large and small banks. By September 2023, total banking sector assets had grown to KES 7.41 trillion, supported by a 14.2 percent increase in loans and advances.

However, due to various challenges and resistance from smaller banks, the recapitalisation plan was not fully implemented as originally intended. The CBK has since continued to focus on other regulatory measures to strengthen the banking sector.

The recapitalisation efforts in these countries reflect a broader trend across Sub-Saharan Africa. Central banks are taking proactive steps to strengthen their banking sectors, ensuring they can withstand economic shocks and support sustainable growth. These measures are crucial for building public confidence and fostering a robust financial ecosystem.

Applying the lessons to Nigeria

As Nigeria approaches its 2026 banking recapitalisation, several strategies can be derived from the experiences of South Africa and Ghana:

Enhancing regulatory frameworks: Strengthening regulatory frameworks will be crucial. The Central Bank of Nigeria (CBN) should enforce stringent capital requirements and ensure regular monitoring to maintain financial stability.

Building market confidence: To attract foreign and domestic investment, it is essential to build and maintain market confidence. Transparent communication and effective implementation of recapitalization measures will be key.

Leveraging technology: Integrating technology into banking operations and regulatory practices can improve efficiency and risk management. Investment in fintech and digital banking platforms can also enhance the customer experience and expand financial inclusion.

Government support: Government intervention, similar to Ghana’s approach, can provide the necessary financial backing and support to banks struggling to meet new capital requirements.

Focus on NPLs and governance: Addressing the issue of non-performing loans and strengthening corporate governance standards will be vital to ensuring the long-term health of the banking sector.

The 2026 banking recapitalisation exercise in Nigeria presents an opportunity to strengthen the country’s financial sector. By drawing on the experiences of South Africa and Ghana, Nigeria can adopt a comprehensive and effective approach to recapitalization, ensuring a resilient and robust banking system capable of supporting economic growth and development. This ongoing process is essential for supporting economic growth, enhancing financial inclusion, and ensuring the long-term health of the banking industry.

Fashola is a junior research and data analyst at BusinessDay Intelligence. He possesses a strong background in conducting financial evaluations and economic analysis.

For inquiries: Nike Alao, Chief Research Officer: +2348034856676

Source link : https://businessday.ng/analysis/article/research-insight-echoes-from-the-past-sub-saharan-africas-journey-in-banking-recapitalisation/?utm_source=auto-read-also&utm_medium=web

Author :

Publish date : 2024-07-11 04:09:15

Copyright for syndicated content belongs to the linked Source.