In a groundbreaking transfer that indicates a shift in Ethiopia’s monetary panorama, the nation has issued its first-ever funding banking licenses, a growth that opens new avenues for financial enlargement and overseas funding. As reported by means of Reuters,this initiative displays the Ethiopian executive’s dedication to modernizing its monetary sector and embellishing its attraction to world buyers. With a protracted historical past of state-dominated banking, the advent of funding banking is poised to develop into the normal banking environment, fostering innovation and festival. This pivotal second now not onyl underscores ethiopia’s aspirations to change into a regional financial hub but in addition marks a notable step towards monetary diversification in a rustic wealthy in untapped doable. Because the country embarks in this new bankruptcy, stakeholders are keenly staring at how those licenses will have an effect on funding developments, financial insurance policies, and the broader socio-economic landscape.

Ethiopia’s Landmark Transfer Towards Monetary Modernization

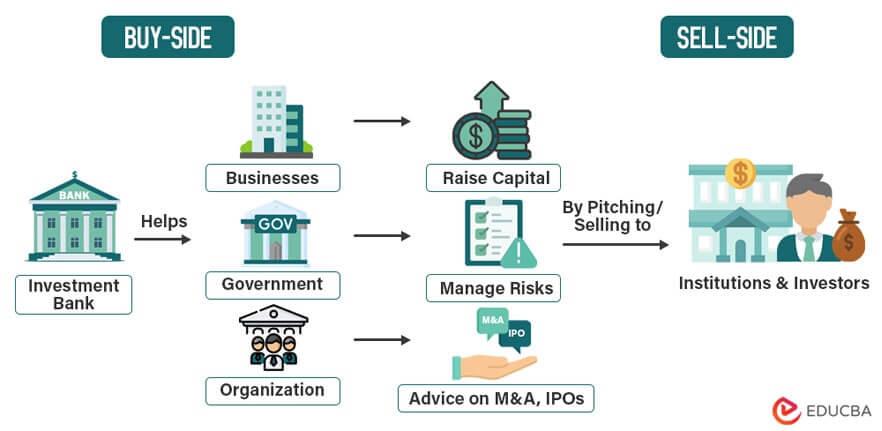

Ethiopia has taken a vital step in opposition to bettering its monetary panorama by means of issuing its first funding banking licenses, marking a pivotal second within the country’s financial adventure. This transfer is anticipated to catalyze the expansion of a powerful non-public funding banking sector, thereby attracting each native and global buyers. With those licenses, establishments are empowered to interact in actions comparable to underwriting securities, providing advisory products and services for mergers and acquisitions, and managing funding budget. The Ethiopian executive’s dedication to monetary modernization is obvious in its efforts to create a extra conducive surroundings for investments.

The advent of funding banking licenses is expected to result in a number of transformative results for the Ethiopian economic system, together with:

- Higher Capital go with the flow: Enhanced get admission to to capital markets will permit companies to lift budget extra successfully, selling entrepreneurship.

- Monetary Experience: Setting up a powerful funding banking sector will foster monetary literacy and experience inside the nation.

- Various Monetary Merchandise: Traders will get pleasure from a wider vary of monetary merchandise adapted to their wishes.

As Ethiopia embarks in this modernization adventure, stakeholders from more than a few sectors are inspired to interact actively, making sure that the advantages of funding banking ripple all the way through the economic system.

Working out the Affect of Funding Banking on Ethiopia’s Financial system

The issuance of the primary funding banking licenses in Ethiopia marks a vital milestone within the country’s financial trajectory. Through growing a structured framework for funding banking,the Ethiopian executive is opening avenues for enhanced capital mobilization,which is very important for infrastructural building and industrialization.This transfer is about to draw each home and overseas investments, resulting in an inflow of budget that may stimulate sectors comparable to agriculture, production, and products and services.Funding banks can act as facilitators for mergers and acquisitions, bond issuance, and long-term investment answers, bettering the full monetary structure of the rustic.

Additionally, the status quo of funding banking will most likely have a ripple impact on activity introduction and talents building. The business will necessitate a team of workers provided with specialised monetary experience, fostering tutorial projects and coaching techniques to provide professional execs. As funding banks take root, they are able to function catalysts for fostering entrepreneurial projects amongst native companies, offering crucial advisory products and services and leading edge monetary merchandise that give a boost to startups and present corporations. this interconnected enlargement will result in a extra resilient economic system in a position to resisting exterior shocks and embellishing the livelihoods of voters.

Key Gamers and Alternatives within the Rising Funding Banking Sector

The new issuance of funding banking licenses in ethiopia marks a transformative second for the country’s monetary panorama, paving the manner for each native and global corporations to have interaction in a number of monetary actions.Key avid gamers on this burgeoning sector are rising from more than a few backgrounds, together with native banks having a look to diversify their products and services, overseas funding establishments looking for untapped alternatives, and fintech innovators aiming to combine fashionable applied sciences into conventional banking practices. Those entities are set to reshape the funding local weather, improve capital markets, and facilitate the mobilization of home and overseas capital.

Attainable alternatives abound for stakeholders on this newly minted funding banking sector. Noteworthy potentialities come with:

- infrastructure Financing: Funding banks can play a the most important position in investment large-scale infrastructure initiatives.

- Advisory Services and products: providing experience in mergers, acquisitions, and public choices for native enterprises looking for enlargement.

- Funding Control: Growing wealth control merchandise adapted for the emerging center magnificence.

- marketplace Construction: Making a extra powerful capital marketplace through leading edge monetary tools.

| Key Gamers | Alternatives |

|---|---|

| Native Banks | Infrastructure Financing |

| global Banks | M&A Advisory Services and products |

| Fintech Corporations | Funding Control |

| Personal Fairness Corporations | Marketplace Construction |

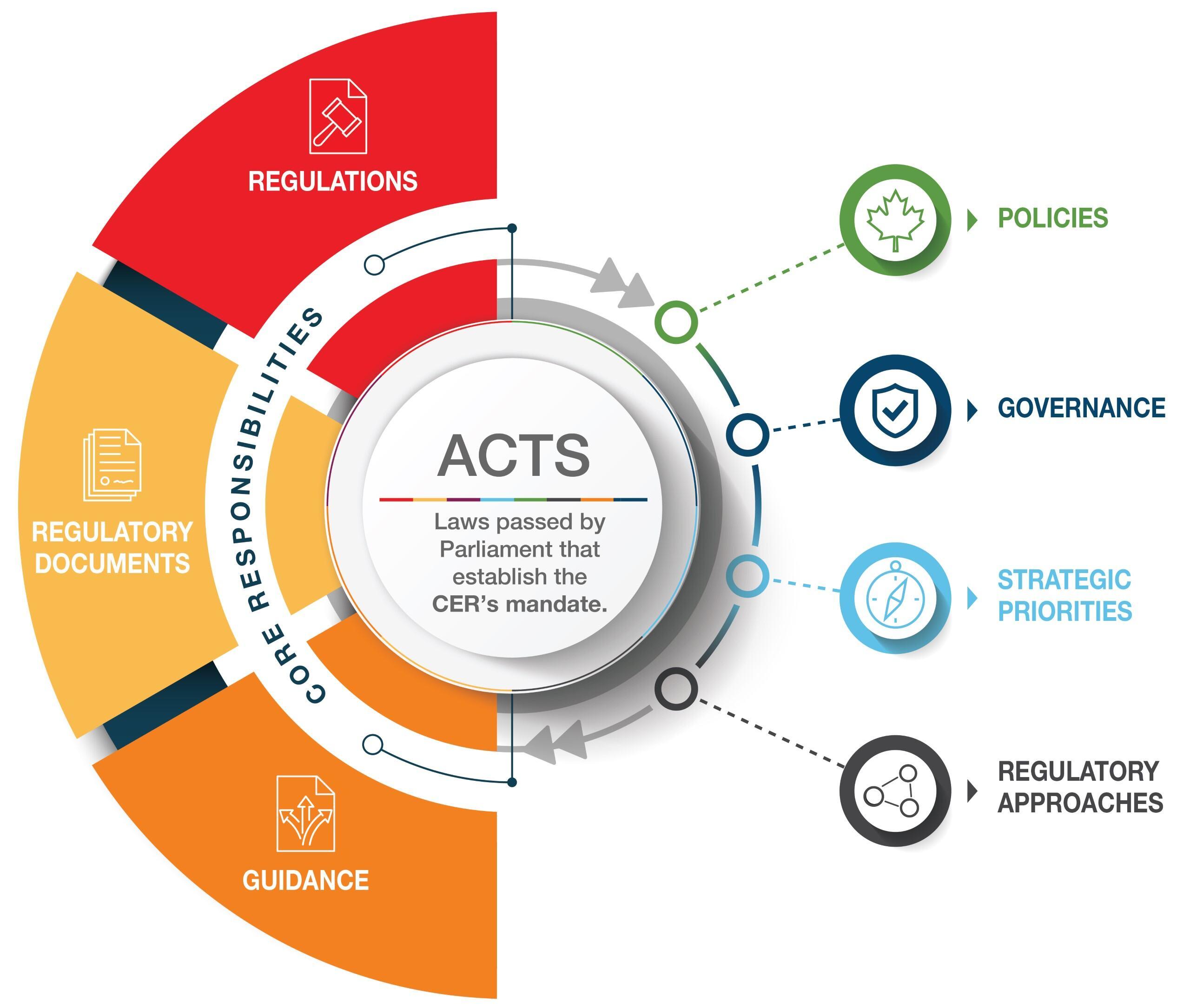

Regulatory Framework: Making sure Compliance and Expansion in Funding Banking

The advent of funding banking licenses in ethiopia marks a pivotal shift within the regulatory panorama, surroundings the level for enhanced compliance mechanisms along trade enlargement. With regulatory government now overseeing this rising sector, there’s a powerful framework that objectives to foster balance and transparency. The federal government’s means is multifaceted, together with:

- Licensing Necessities: Strict standards for doable funding banks to verify monetary soundness and moral operations.

- Shopper Coverage: Tips to safeguard the pursuits of buyers and purchasers inside the banking gadget.

- Compliance Tracking: common tests by means of regulatory our bodies to verify adherence to monetary rules.

This regulatory framework is anticipated not to most effective inspire native buyers but in addition draw in overseas capital, as global buyers steadily prioritize areas with transparent governance and risk management practices. Through setting up clear evaluative standards,Ethiopia is transferring in opposition to a extra predictable funding surroundings,which is the most important for sustainable financial enlargement. Key parts of this technique come with:

| Key Parts | Affect |

|---|---|

| Chance Overview Protocols | Enhanced due diligence on funding alternatives. |

| Transparency Projects | Higher investor self assurance thru transparent reporting and duty. |

| Steady Training | Common coaching for monetary practitioners on compliance and ethics. |

Subsequent Steps for Traders: Making the Maximum of ethiopia’s New Panorama

As Ethiopia embarks on a brand new bankruptcy with the issuance of its first funding banking licenses, buyers are offered with an array of alternatives on this burgeoning marketplace. To successfully navigate this evolving panorama, it’s the most important for stakeholders to perceive the regulatory framework being established. Attractive with native monetary government and collaborating in business seminars may give insights into compliance necessities and operational requirements,paving the manner for strategic investments.

As well as, buyers shoudl focal point on construction partnerships with native corporations to improve marketplace penetration and leverage native experience.Believe the next methods to optimize funding results:

- Behavior thorough marketplace analysis to establish sectors with prime enlargement doable.

- Collaborate with Ethiopian companies to verify alignment with cultural and operational practices.

- Keep knowledgeable on macroeconomic developments and insurance policies that can have an effect on funding local weather.

Additionally, buyers would possibly to find price in exploring the next sectors the place call for is projected to develop:

| Sector | Anticipated Expansion Affect |

|---|---|

| Agribusiness | prime – Expanding call for for exports and meals safety projects. |

| Renewable Power | Medium – Executive projects selling sustainable power assets. |

| Telecommunications | Top – Liberalization of the field opens new provider alternatives. |

Attainable Demanding situations Going through Ethiopia’s Funding banking Trade

The emergence of Ethiopia’s funding banking sector is a vital step in opposition to financial modernization, but it faces a number of demanding situations that may obstruct its enlargement and effectiveness. Regulatory complexities can be a number one worry; setting up a powerful felony framework that fosters transparency and investor self assurance is the most important. The loss of a complete regulatory surroundings would possibly deter each native and global buyers, leading to a limited go with the flow of capital. Moreover, the want for experienced execs inside of the business items a hurdle. Because the marketplace develops, there can be a urgent call for for execs who’re well-versed in funding banking ideas, monetary research, and possibility control.

Moreover, marketplace volatility stays an underlying danger, specifically for a country present process important financial transitions. Traders may doubtlessly be anxious about making an investment in a marketplace characterised by means of unpredictable financial stipulations and political dynamics. Infrastructure demanding situations additionally pose important obstacles; deficiencies in technological frameworks and fiscal programs would possibly restrict operational efficiencies for newly authorized corporations.To navigate those hindrances effectively, the funding banking business will have to adapt and innovate often, cultivating a panorama that balances possibility with alternatives for sustainable enlargement.

In Retrospect

Ethiopia’s groundbreaking choice to factor its first funding banking licenses marks a vital milestone within the country’s financial evolution. This strategic transfer now not most effective opens the door for brand spanking new monetary products and services inside of the rustic but in addition alerts a broader dedication to modernize and diversify Ethiopia’s monetary panorama. Because the country integrates extra subtle banking practices,it’s poised to improve its good looks to each home and global buyers,most likely riding financial enlargement and innovation. With the monetary sector poised for transformation, stakeholders can be keenly looking at how those trends spread and have an effect on Ethiopia’s aspirations for sustainable building and enhanced world financial participation.

Source link : https://afric.news/2025/04/03/ethiopia-issues-first-investment-banking-licenses-reuters/

Creator : Ethan Riley

Post date : 2025-04-03 12:15:00

Copyright for syndicated content material belongs to the related Source.