Startups in Kenya and Egypt were the top recipients of equity funding from investors in Africa in the first half of 2023 (H1 2023), according to a new report by Briter Bridges.

Kenya came in first place with $520m, Egypt second with $510m, followed by South Africa at $400m, Rwanda at $330m, and Nigeria came fifth at $280m.

Regarding the deal volumes, the report indicated that Nigeria closed 100 deals, while Kenya has closed over 80 deals so far, followed by South Africa with over 60 deals, Ghana with over 35 deals, and Egypt with over 15 deals in H1 2023.

The report indicated that Africa’s innovation industry is now worth more than $21bn.

However, this milestone has come at a time when the change in the global macro environment is raising questions about the viability of investing in startups, let alone in Africa.

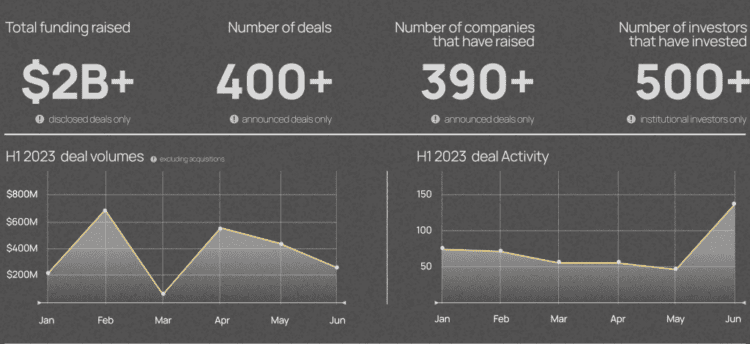

It indicated that the first six months of 2023 have been particularly challenging for startups and investors alike looking to raise funding. The volume of funding dropped by 26% from H2 2022 to H1 2023 and has largely been on a downward trend in 2023 even when factoring in substantial mega deals (those exceeding $100m) such as MTN Halan and Planet42.

This was most evident as startup funding in the continent experienced a decline to $1bn during the first half of 2023, in contrast to the $1.5bn in the second half of 2022 and $1.8bn in the first half of 2022.

Funding to startups in Africa peaked from Q3 2021 to Q1 2022 with the downturn in funding volumes starting in Q2 2022. Each quarter following Q2 saw a decrease in the volume of deals. By Q4, the volume of deals was down more than 50%.

“The volume of funding dropped by 26% from H2 2022 to H1 2023 and has largely been on a downward trend in 2023. The effect is that investors were shifting focus from growth-stage startups to late and early-stage ones.”

Moreover, Briter Bridges said that mega deals account for a significant majority of total disclosed volumes.

“While this has been a recurrent feature over the years, there exists a noteworthy shift in the composition of investors who are taking the lead in these substantial transactions,” the report indicated.

Historically, VCs have been at the forefront of mega deals. However, a distinct evolution is now evident, as development finance institutions (DFIs) and corporate venture entities have emerged as prominent players spearheading these deals.

Source link : https://www.dailynewsegypt.com/2023/08/28/kenya-egypt-top-africa-in-startup-funding-volume-in-h1-2023/

Author :

Publish date : 2023-08-28 07:00:00

Copyright for syndicated content belongs to the linked Source.