Population and health

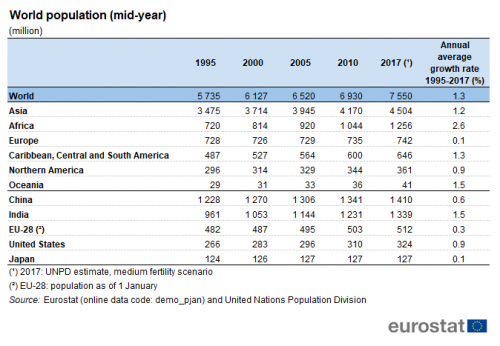

With the world’s population at more than 7.5 billion inhabitants in 2017, Africa with almost 1.3 billion people has the second largest continental population, well below the largest population of 4.5 billion in Asia. However, the growth rate of Africa’s population was on average 2.6 % per year between 1995 and 2017, the highest of all continents. This was double the 1.3 % growth rate for the world population and more than double the 1.2 % growth rate for Asia. In contrast, the population of Europe barely changed over the same period; the EU-28 growth rate averaged 0.3 % per year during this period, while the growth rate for Europe as a whole was only 0.1 %. Africa’s population rose from 720 million in 1995 (slightly less than the European total of 728 million at that time) to almost 1.3 billion in 2017, substantially more than the European total (742 million) and more than twice the EU-28 total (512 million).

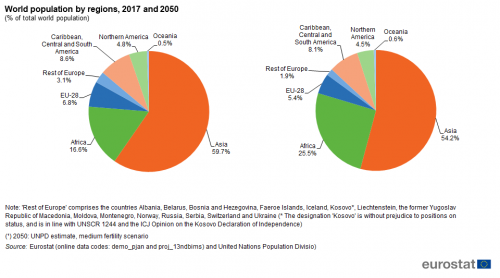

Although Africa’s population has grown faster than that of China (0.6 %) and India (1.5 %), it still remains below the population of these two countries in 2017 (China 1.4 billion; India 1.3 billion). On the other hand, Africa’s population was larger than the combined population of North and South America and almost four times the size of the United States. In 2017, Africa accounted for 16.6 % of the world’s population, compared to 9.9 % for Europe as a whole and 6.8 % for the EU-28 (Table 1 and Figure 1).

Table 1: World population (mid-year)

Table 1: World population (mid-year)

(million)

Source: Eurostat (demo_pjan) and United Nations Population Division Figure 1: World population by regions, 2017 and 2050

Figure 1: World population by regions, 2017 and 2050

(% of total world population)

Source: Eurostat (demo_pjan) and (proj_13ndbims) and United Nations Population Division

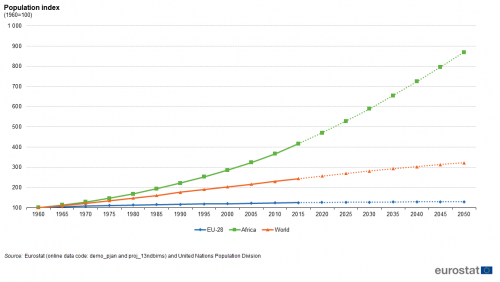

Population projections up to 2050 (Figure 1 and Figure 2) show a continuation of this trend. Africa’s population is forecast to double to almost 2.5 billion by 2050. The European Union population is projected to continue growing towards 2050, but with declining growth rates especially in the final decade up to 2050. The main reason for this difference is that the current population in African countries is substantially younger than in the European Union Member States.

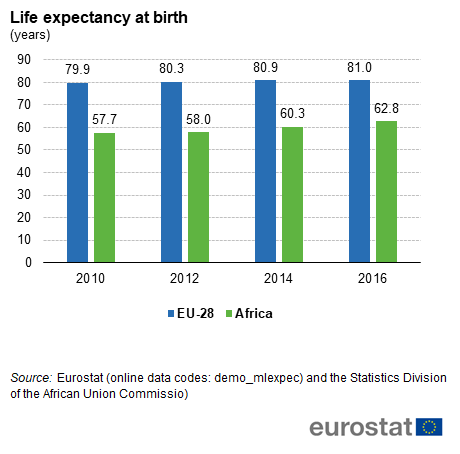

There is a vast difference in life expectancy at birth between Africa and the European Union (Figure 3). In 2016, the life expectancy in Africa was 62.8 years, compared to 81.0 years in the European Union. However, life expectancy is slowly growing in both the European Union and in Africa. Within Africa, there are large differences between countries. This heterogeneity should be kept in mind when analysing the data. Generally, life expectancy in North Africa and in several smaller African island states such as Cape Verde, Mauritius and the Seychelles is close to the European level. In all of these countries, the life expectancy at birth was well over 70 years in 2016, ranging from 72 years in Egypt up to 78 years in Algeria. However, in Sierra Leone the life expectancy was only 52 years in 2016. Also in a number of other Sub-Saharan countries, including Lesotho, Nigeria, the Central African Republic, Chad and Côte d’Ivoire, life expectancy at birth was less than 55 years. The main reasons for this are the high prevalence of AIDS, in particular in Southern Africa, the effects of civil wars and violent conflicts, as well as poverty and limited access to effective health treatment.

Africa’s higher forecasted population growth is also due to a higher proportion of women in childbearing age and a higher fertility rate than in the European Union, both more than compensating the lower life expectancy.

Figure 3: Life expectancy at birth

Figure 3: Life expectancy at birth

(years)

Source: Eurostat (demo_mlexpec) and the Statistics Division of the African Union Commission

In many African countries the health care systems are less advanced. In addition, there is a relatively high prevalence of diseases connected to insufficient access to sanitation and clean drinking water, to sufficient and safe nutrition as well as generally difficult living conditions.

The African Health Strategy for 2007 to 2015 was developed to address these challenges. It provided a strategic framework for African countries, supporting them in their efforts towards reaching the Millennium Development Goals related to health. A revised Africa Health Strategy has been developed for the period 2016-2030. This is based on an assessment of the strategy for 2007-2015, the relevant African Union health policy instruments and integrating research and innovation for health. The policy framework is anchored to key African and global health policy commitments and instruments, in particular the Agenda 2063: The Africa We Want and the Sustainable Development Goals.

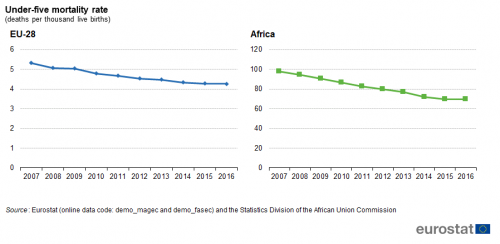

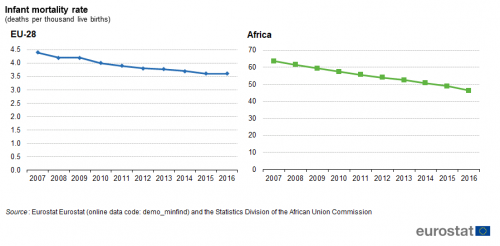

In this context, the infant mortality rate is a good indicator of the impact of the efforts made by national health systems. From 2007 to 2016, the African under-five mortality rate, i.e. the probability that a new-born baby will die before reaching the age of five years old (measured against a thousand live births) has decreased from 98.1 to 69.7 (Figure 4). In many African countries, most of these deaths happen in the first year after birth. It is thus encouraging that also the infant mortality rate in Africa dropped significantly between 2007 and 2016, from 63.5 to 46.3 deaths per thousand new-borns (Figure 5). The corresponding EU-28 rate fell from 4.4 deaths in 2007 to 3.6 deaths in 2016.

Despite the significant reduction in both of these mortality rates, it should be taken into account that for some years, due to the lack of data available, the calculation has been made with data from only a few countries.

Figure 4: Under-five mortality rate

Figure 4: Under-five mortality rate

(deaths per thousand live births)

Source: Eurostat (demo_magec) and (demo_fasec) and the Statistics Division of the African Union Commission Figure 5: Infant mortality rate

Figure 5: Infant mortality rate

(deaths per thousand live births)

Source: Eurostat (demo_minfind) and the Statistics Division of the African Union Commission

Economic performance

Table 2 shows the relative economic performance of Africa and the European Union compared to other selected countries and the world as a whole.

In 2017, the gross domestic product (GDP) at current prices of the EU-28 stood at over EUR 15 377 billion, whilst the figure for Africa was EUR 1 952 billion. In comparison, the GDP for the United States was EUR 16 290 billion, for China EUR 10 281 billion, for Japan EUR 4 093 billion and for India EUR 2 182 billion. Other major economies were Brazil, Canada and Russia, with GDP between EUR 1 325 billion and EUR 1 726 billion, all below the total GDP of Africa.

Africa saw its share of world GDP growing between 2007 and 2012; however, by 2017 the share had fallen to 2.9 %. However, this was still higher than ten years earlier, when Africa’s share of world GDP was 2.4 %. In 2007, the EU-28’s share of world GDP stood at 28.8 %. By 2012, following the inertia of the worldwide economic crisis, this share had fallen to 23.1 %. Although the European Union’s GDP at current prices had regained and surpassed the level prior to the economic crisis, the European Union’s share of world GDP was down to 22.7 % in 2017. There was no consistent picture for the other major economies. While the USA, Japan and Canada recorded a decline in their share of world GDP over the last decade, China’s share almost tripled.

Table 2: Gross domestic product at current prices

Table 2: Gross domestic product at current prices

Source: Eurostat (nama_10_gdp) and (nama_10_pc), the Statistics Division of the African Union Commission and World Bank

The positive trend in Africa’s share of world GDP in the first half of the last decade was due to strong GDP growth rates in most African countries. However, over the past years, the effects of an unstable security situation have become evident in the GDP growth figures for a number of countries. In addition, fluctuations in world market prices for raw materials, and in particular the decline in prices of crude oil and natural gas, have curtailed the economic output of a number of countries. Nevertheless, the GDP growth rates of the best performing African countries from 2016 to 2017 outstripped the growth rates of the best performing EU countries (Figure 6). Ethiopia topped the list with a GDP growth of 10.3 %, followed by Ghana (8.5 %) and the Democratic Republic of Congo (7.6 %). These African countries recorded higher GDP growth rates in 2017 than the best performing European Union Member State, Ireland, with 7.2 %.

Figure 6: GDP growth rates at constant prices, top 10 EU Member States and top 10 African countries, 2017

Figure 6: GDP growth rates at constant prices, top 10 EU Member States and top 10 African countries, 2017

(%)

Source: Eurostat (tec00115) and the Statistics Division of the African Union Commission

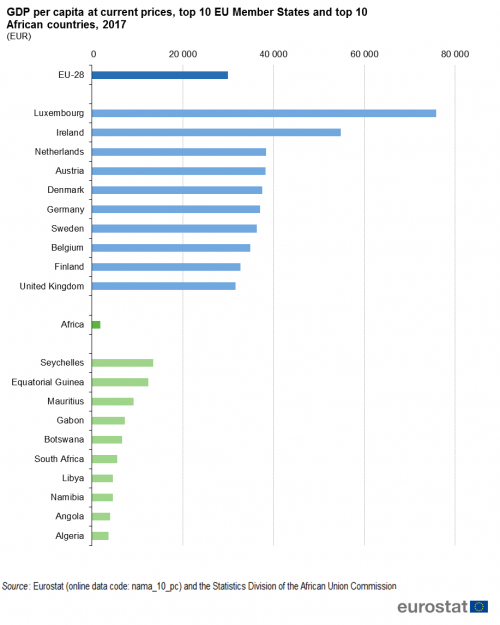

A different perspective emerges when comparing GDP per capita. In the USA and Canada, the GDP in euros per inhabitant was well above the European Union as a whole in 2017, with EUR 50 000 for the USA and EUR 37 800 for Canada (Table 2). The EU-28 level of EUR 30 000 per capita was also surpassed by Japan, with a GDP per capita of EUR 40 800 in 2017. However, the GDP per capita of these three countries and the EU-28 lay far above the values of Brazil, India, Russia and China. The EU-28 GDP per capita rose by EUR 3 900 (15 %) in the decade from 2007 to 2017. The estimated figure for Africa in 2017, EUR 1 900 per capita, represented a rise of more than 70 % compared to 2007. In comparison, the Indian GDP per capita of EUR 1 400 in 2017 was far below that of Africa. Russia recorded a GDP per capita of EUR 9 000 and Brazil a value of EUR 8 300. By 2017, China’s GDP per capita had grown to EUR 7 400, more than three and a half times the value recorded in 2007.

At country level, GDP per capita in most African countries is still low (Figure 7). With a small population, and fuelled by its offshore industry and extensive tourism, the Seychelles led the African top 10 in 2017; its GDP per capita of EUR 13 500 was higher than in several EU Member States. With EUR 12 400, Equatorial Guinea also recorded a relatively high GDP per capita in 2017. This represented a sharp contrast compared to other African countries like Burundi (EUR 200) and the Central African Republic, Malawi and Niger (all around EUR 300).

Figure 7: GDP per capita at current prices, top 10 EU Member States and top 10 African countries, 2017

Figure 7: GDP per capita at current prices, top 10 EU Member States and top 10 African countries, 2017

(EUR)

Source: Eurostat (nama_10_pc) and the Statistics Division of the African Union Commission

Prices and public finances

Figure 8 shows the evolution in consumer prices in the EU-28 and Africa since 2008. Price volatility in Africa has been substantially larger than in the EU-28 throughout the period. In Africa, inflation, i.e. the year-on-year change in consumer prices, was 8.0 % in 2010, following a sharp decrease from 10.7 % in 2008 and 9.7 % 2009. In the years 2013-2016, inflation in Africa stabilised between 7.0 % and 7.4 %, only to rise again in 2017 (10.1 %). On average, African inflation ran at a rate of 8.6 % per year between 2008 and 2017. In the EU, inflation was at 3.7 % in 2008. However, in connection with the worldwide economic crisis, inflation in the EU fell sharply to 1.0 % in 2009 before increasing again during the recovery in 2010 and 2011. In the subsequent years, EU inflation fell steadily, reaching 0.0 % in 2015. After picking up slightly to 0.3 % in 2016, EU inflation rose to 1.7 % in 2017.

Figure 8: Inflation rate

Figure 8: Inflation rate

(% annual growth)

Source: Eurostat (prc_hicp_aind) and the Statistics Division of the African Union Commission

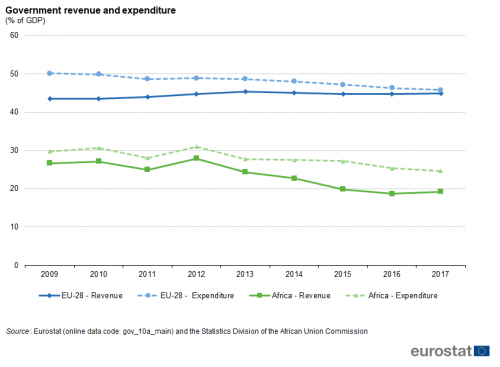

Africa’s government revenue and expenditure, as percentage of GDP, were at a lower level than in the EU-28 throughout the period 2009-2017 (Figure 9). For both revenue and expenditure, African values have generally been between 20 % and 30 % of GDP. Although both government revenue and expenditure have been falling steadily for Africa since 2012, this trend changed slightly in 2017 with revenue raising to 19.2 % of GDP while expenditure fell to 24.6 % of GDP.

In comparison to the government revenue and expenditure in Africa, the corresponding values for the EU were relatively stable, ranging between 43 % and 50 % of GDP over the period 2009-2017. In 2017, the EU-28 government revenue remained little changed at 44.9 % of GDP, while the expenditure fell slightly to 45.8 % of GDP. Government expenditure exceeded revenue for both Africa and the EU over the reference period. The difference between expenditure and revenue, i.e. the fiscal balance, was negative for the EU-28 over the whole period 2008-2016. However, following higher fiscal deficits during the economic crisis, -6.6 % and -6.4 % in 2009 and 2010 respectively, the deficit in the EU-28 has steadily decreased and stood at -0.9 % in 2017. In comparison, Africa retained the fiscal deficit at a stable level ranging between -3.1 % and -3.4 % over the period 2009-2013, before the fiscal deficit started to grow and reached a local peak of -7.4 % in 2015. However, thanks to the gradual reduction in government expenditure since 2012, combined with a slight upturn in government revenue, the African fiscal deficit had been reduced to -5.4 % by 2017.

Although African government revenue increased to 19.2 % in 2017, this was the lowest level of government revenue in the period since 2009 (with the exception of 2016). At the same time, government expenditure was at its lowest level in the period since 2009. Although there is a tendency towards higher levels of both government revenue and expenditure in countries that are rich in natural resources such as Libya, Angola, Algeria and Equatorial Guinea, the level varies greatly across Africa. However, almost all of the countries that recorded decreases in government revenue (as a share of GDP) also recorded decreases in expenditure, to a certain extent mitigating the negative effect of falling revenues on the fiscal balance.

Figure 9: Government revenue and expenditure

Figure 9: Government revenue and expenditure

(% of GDP)

Source: Eurostat (gov_10a_main) and the Statistics Division of the African Union Commission

International trade

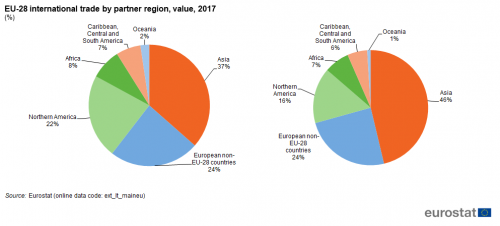

Africa accounted for around 7 % of imports to the EU-28 and 8 % of the EU-28’s exports in 2017, measured by value (Figure 10). This was far behind Asia, which accounted for 46 % of imports to the EU-28 and 37 % of exports. As a comparison, Northern America accounted for 16 % of EU-28 imports but was the destination for 22 % of EU-28 exports.

Figure 10: EU-28 international trade by partner region, value, 2017

Figure 10: EU-28 international trade by partner region, value, 2017

(%)

Source: Eurostat (ext_lt_maineu)

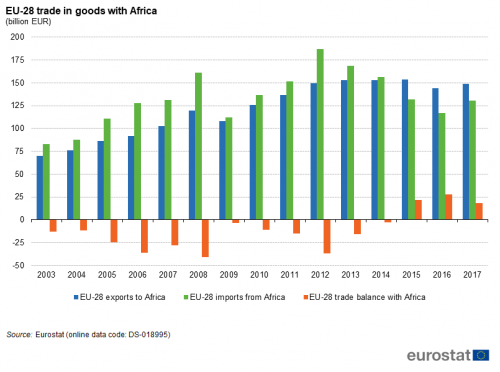

The EU-28 trade balance for goods with Africa was negative in all years between 2003 and 2014, but turned to a surplus from 2015 onwards (Figure 11). The European Union’s trade deficit with Africa fell sharply from EUR 41.2 billion in 2008 to EUR 3.8 billion in 2009, clearly reflecting the worldwide economic crisis, with both import and export values dropping. This fall in both imports and exports broke the steady increase in trade between the EU-28 and Africa between 2003 and 2008, which had seen EU-28 exports to Africa rise by 71 % and imports by 94 % over this period. From 2009 to 2012, EU-28 exports to Africa increased again, before stabilising at around EUR 153 billion from 2013 to 2015. Following a fall to around EUR 144 billion in 2016, EU-28 exports to Africa rebounded to EUR 149 billion in 2017.

Correspondingly, following the worldwide economic crisis, in the years 2009-2012 EU-28 imports from Africa resumed their strong growth, exceeding the pre-crisis value by 16 % in 2012. However, the value of EU-28 imports from Africa subsequently fell each year between 2013 and 2016, before rising to EUR 130.8 billion in 2017. That corresponded to a slump of almost 30 % in the value of EU imports from Africa compared to the peak of EUR 186.7 billion recorded in 2012. By far the main cause for this was the fall in value of crude oil and natural gas imports from Africa, due in large part to falling world market prices for these products.

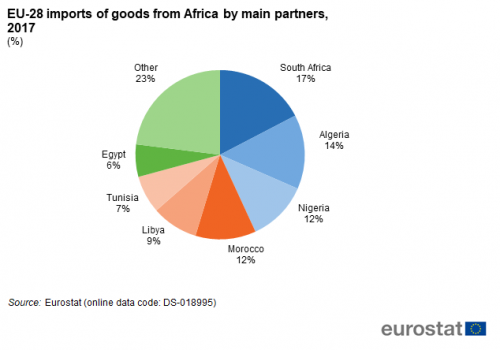

In 2017, the main African partners for EU-28 imports of goods were South Africa (17 % of total import value from Africa), Algeria (14 %), Nigeria and Morocco (12 % each) (Figure 12). Together, these four countries accounted for more than one half of EU-28 imports from Africa. In the case of South Africa, the main products sold to the EU-28 were gold (non-monetary) and motor vehicles for the transport of persons. Morocco mainly sold equipment for distributing electricity to the EU-28.

Figure 11: EU-28 trade in goods with Africa

Figure 11: EU-28 trade in goods with Africa

(billion EUR)

Source: Eurostat (DS-018995) Figure 12: EU-28 imports of goods from Africa by main partners, 2017

Figure 12: EU-28 imports of goods from Africa by main partners, 2017

(%)

Source: Eurostat (DS-018995)

Due to the decline in world market prices for crude oil and natural gas, the value of the trade in petroleum products has dropped; important African trade partners for petroleum products such as Algeria and Nigeria have seen their share in EU-28 imports falling in recent years. Libya has experienced an even stronger fall in its share of EU-28 imports, partly due to lower petroleum prices and partly due to the continued instability in the country since 2011. In 2013, Libya ranked third among African importers to EU-28, accounting for 14 % of the import value; in recent years, Libya is recovering little by little, ranking fifth in 2017 with 9 % of the import value from Africa.

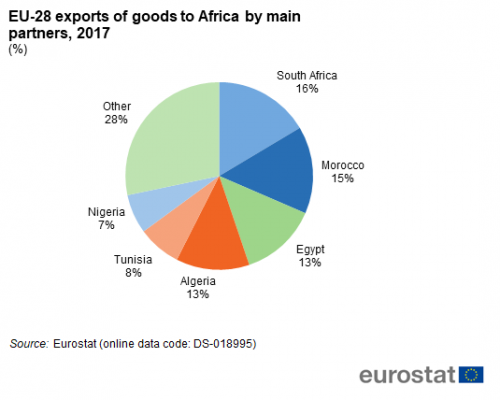

In 2017, the main African destinations for EU-28 exports were South Africa, accounting for 16 % of the exports, followed by Morocco (15 %), Egypt and Algeria (both 13 %) (Figure 13).

Figure 13: EU-28 exports of goods to Africa by main partners, 2017

Figure 13: EU-28 exports of goods to Africa by main partners, 2017

(%)

Source: Eurostat (DS-018995)

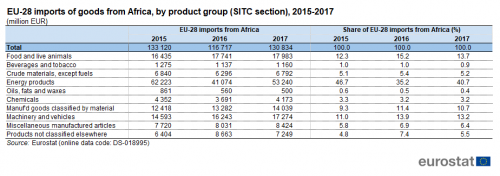

Considering the products traded, the EU-28’s major imports from Africa were above all energy products (Table 3). For these products, in particular for crude oil, Africa is second only to Russia as an EU-28 import source. Falling since 2012, the trend changed in 2017 when the value of energy product imports from Africa rose to EUR 53.2 billion. This made up 40.7 % of EU-28 imports from Africa that year. Other important groups of goods imported from Africa were food and live animals (13.7 % of total EU-28 imports from Africa), machinery and vehicles (13.2 %), as well as manufactured products classified by material (10.7 %).

Table 3: EU-28 imports of goods from Africa, by product group (SITC section), 2015-2017

Table 3: EU-28 imports of goods from Africa, by product group (SITC section), 2015-2017

(million EUR)

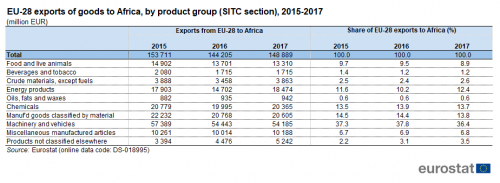

Source: Eurostat (DS-018995) Table 4: EU-28 exports of goods to Africa, by product group (SITC section), 2015-2017

Table 4: EU-28 exports of goods to Africa, by product group (SITC section), 2015-2017

(million EUR)

Source: Eurostat (DS-018995)

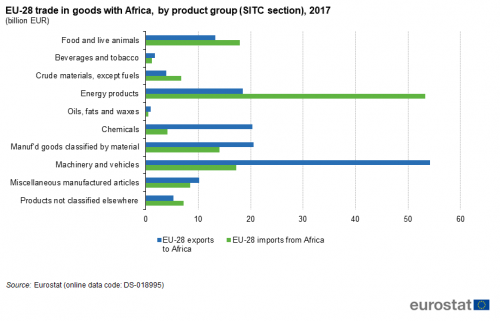

In 2017, EU-28 exports to Africa mainly consisted of processed products. The main product group was machinery and vehicles, in particular road vehicles, with EUR 5.2 billion. This product group accounted for 36.4 % of total EU-28 export value to Africa (Table 4). Other important product groups were manufactured products classified by material (around EUR 20.6 billion) and chemicals (nearly EUR 20.4 billion), accounting for 13.8 % and 13.7 % of the value of EU-28 exports to Africa in 2017 respectively (Figure 14). For EU-28 trade in energy products with Africa, there was a significant reverse flow of refined oil products exported from EU-28 to Africa, amounting to some EUR 18.5 billion (12.4 %) in 2017.

From 2016 to 2017, the value of EU-28 exports to Africa of machinery and vehicles, by far the largest product group, fell by 0.5 %. Amongst the other main product groups, the value of exports to Africa dropped by 0.8 % also for manufactured products classified by material. On the other side, the African demand for energy products rose by 25.7 %, and also demand for chemicals grew by almost 1.9 %.

On the import side, the value of imports of energy products from Africa was volatile. It rose by 29.6 % between 2016 and 2017, following falls of almost 18 % in 2016, one third in 2015 and 15 % in 2014. This downturn was partly due to the falling world market prices for petroleum products and partly due to decreasing quantities imported from a number of important countries in 2014 and 2015. This decline continued during 2016, but the trade in these products started recovering in 2017. There was in particular a strong recovery in the volumes of energy products imported from Libya (150.9 %). Also imports from Algeria (14.3 %), Egypt (11.8 %) and South Africa (11.6 %) rebounded. In addition to energy products, there were also significant increases in the value of chemicals and crude materials imported from Africa to the EU-28 (13.1 % and 7.9 % respectively).

Figure 14: EU-28 trade in goods with Africa, by product group (SITC section), 2017

Figure 14: EU-28 trade in goods with Africa, by product group (SITC section), 2017

(billion EUR)

Source: Eurostat (DS-018995)

Services and the digital economy and society

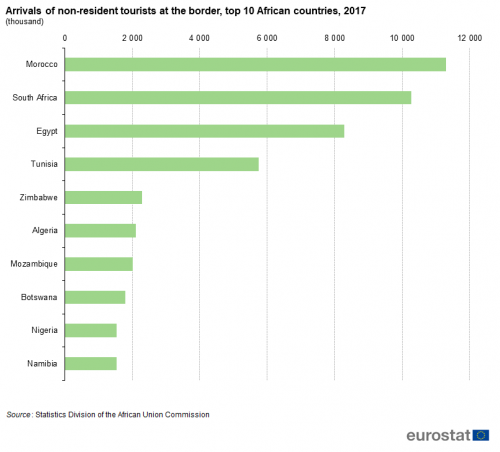

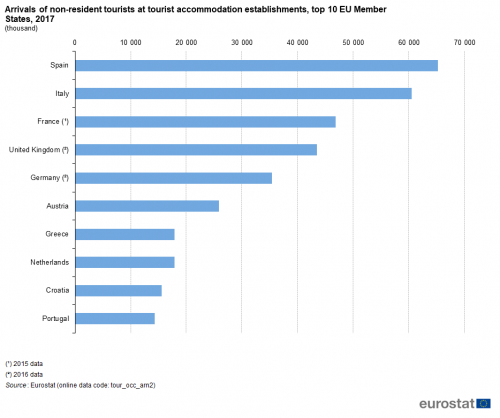

Tourism contributes considerably to the economy of many African countries. In 2017, the total number of arrivals of non-resident tourists at the border of African countries amounted to 64.2 million, up 7.4 % on the previous year. Several African countries recorded high tourist numbers in 2017. Figure 15 presents the Top 10 countries in Africa and the European Union in terms of the non-resident tourist arrivals. One has, however, to note that the European Union data record arrivals at tourist accommodation establishments. Thus, on the one hand, European Union figures do not record tourists arriving in non-rented accommodation (e.g. owned second homes, visits to relatives and friends with accommodation free of charge). On the other hand, tourists travelling inside the country and staying in more than one tourist accommodation establishment during their trip are counted as a new arrival each time they check-in at an accommodation establishment. Therefore, the figures for European Union Member States cannot be directly compared to the figures for African countries, which record tourist arrivals at the border.

Morocco, South Africa, Egypt and Tunisia together accounted for more than half of all non-resident tourist arrivals in Africa in 2017. Most of the North African countries registered a strong increase in the number of tourists up to the year 2010. However, following the civil uprisings during the Arab spring and the uncertain security situation thereafter, the numbers of non-resident tourists fell considerably in several countries. In Egypt, arrivals peaked at 14.7 million in 2010, making it the main tourist destination in Africa that year, before falling by a third in 2011. In 2017, Egypt recorded just short of 8.3 million non-resident tourists arriving. This was, however, still the third highest number among the African countries.

An exception in North Africa is Morocco, where the security situation has remained stable over the reference period. The number of non-resident tourist arrivals in Morocco has grown steadily since 2006, with only a slight slow-down in 2012. In 2017, the number of arriving tourists stood at 11.3 million, making Morocco the largest tourist destination in Africa. South Africa, as the previous year, remained the second largest tourist destination in Africa with 10.3 million tourist arrivals in 2017. This represented an increase by 1.7 % compared to the tourist arrivals in 2016. After Egypt in third place, Tunisia followed far behind in fourth place, recording 5.8 million tourist arrivals in 2017.

Figure 15a: Arrivals of non-resident tourists at the border, top 10 African countries, 2017

Figure 15a: Arrivals of non-resident tourists at the border, top 10 African countries, 2017

(thousands)

Source: Statistics Division of the African Union Commission Figure 15b: Arrivals of non-resident tourists at tourist accommodation establishments, top 10 EU Member States, 2017

Figure 15b: Arrivals of non-resident tourists at tourist accommodation establishments, top 10 EU Member States, 2017

(thousands)

Source: Eurostat (tour_occ_arn2)

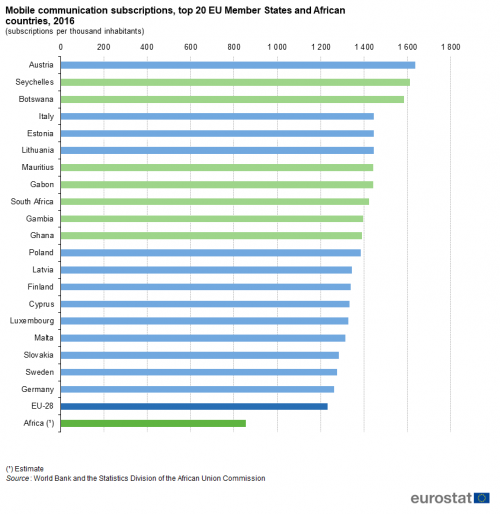

Telecommunications are crucial for developing a digital economy and society and for providing access to new services and information. Therefore, telecommunications play an important role in national development and the global economy. As fixed network infrastructure is expensive and takes long to build, especially in remote and thinly populated areas, mobile networks have taken a prominent role in the development of the telecommunications sector and the digital economy and society in Africa. As a result, mobile communication penetration has risen rapidly over the last decade. In 2016, the number of mobile communication subscriptions per thousand inhabitants in Africa reached an estimated 854, which was almost four times higher than a decade previously (Figure 16).

In terms of mobile communication subscriptions per inhabitant, the top 20 list for Africa and the European Union in 2016 includes the Seychelles, Botswana, Mauritius, Gabon, South Africa, Gambia and Ghana. These African countries recorded mobile communication penetration rates that matched the highest rates in the European Union Member States, all above the EU-28 average of 1 231 mobile communication subscriptions per thousand inhabitants.

Some African countries lagged far behind, however, e.g. Eritrea with only 73 subscriptions per thousand inhabitants in 2016. South Sudan and the Central African Republic also had low mobile communication penetration, recording 215 and 255 subscriptions respectively in 2016. Madagascar, Malawi, Côte d’Ivoire and Djibouti also recorded rates of less than half the African average of 854 subscriptions. Nevertheless, most of the African countries with a low mobile communication penetration registered high growth rates. Over the years 2006 to 2016, the highest growth rate was actually recorded in Ethiopia, where a penetration of 11 per thousand inhabitants in 2006 had increased to 505 in 2016. Other countries recording exceptional growth in mobile communications penetration over the last decade are Mali, Rwanda, Guinea and the Comoros, all from very low starting levels.

Figure 16: Mobile communication subscriptions, top 20 EU Member States and African countries, 2016

Figure 16: Mobile communication subscriptions, top 20 EU Member States and African countries, 2016

(subscriptions per thousand inhabitants)

Source: World Bank and the Statistics Division of the African Union Commission

Source data for tables and graphs

Data sources

Data sources

The content of this article is based on data for African countries, provided by the Statistics Division of the African Union Commission. These data were produced by the National Statistical Institutes or National Central Banks of the African countries or by international organisations (United Nations, OECD, IMF, World Bank and ILO). Data on the European Union and on trade between Africa and the European Union have been extracted from Eurostat’s databases Eurobase and Comext.

African economic data (GDP, government finances, trade) were provided in US Dollars or in national currencies; they have been converted to EUR using the average annual rate of exchange. The exchange rates are published by the European Commission under InforEuro

This article is based on the most recent edition of the statistical compendium ‘The European Union and the African Union — A statistical portrait’; data for further statistical areas and indicators can be found there, for all available African Union member countries and European Union Member States.

African data are also available in the African Statistical Yearbook, prepared jointly by the African Union Commission, the African Development Bank and the United Nations Economic Commission for Africa.

African countries

Algeria, Angola, Benin, Botswana, Burkina Faso, Burundi, Cameroon, Cape Verde, Central African Republic, Chad, Comoros, Congo, Côte d’Ivoire, Democratic Republic of Congo, Djibouti, Egypt, Equatorial Guinea, Eritrea, Ethiopia, Gabon, Gambia, Ghana, Guinea, Guinea-Bissau, Kenya, Lesotho, Liberia, Libyan Arab Jamahiriya, Madagascar, Malawi, Mali, Mauritania, Mauritius, Morocco, Mozambique, Namibia, Niger, Nigeria, Rwanda, Sao Tome and Principe, Senegal, Seychelles, Sierra Leone, Somalia, South Africa, South Sudan, Sudan, Swaziland, Tanzania, Togo, Tunisia, Uganda, Zambia and Zimbabwe. Data for South Sudan are only available for a limited number of tables.

European Union Member States

Belgium, Bulgaria, Czechia, Denmark, Germany, Estonia, Ireland, Greece, Spain, France, Croatia, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Hungary, Malta, the Netherlands, Austria, Poland, Portugal, Romania, Slovenia, Slovakia, Finland, Sweden and the United Kingdom

International merchandise trade statistics

In the methodology applied for statistics on the trading of goods, extra-EU trade (trade between Member States and non-member countries) statistics do not record exchanges involving goods in transit, placed in a customs warehouse or given temporary admission (for trade fairs, temporary exhibitions, tests, etc.). This is known as “special trade”; the partner recorded will be the country of final destination of the goods.

SITC classification

In Tables 3 and 4 and Figure 14, information on commodities exported and imported are presented according to the Standard international trade classification (SITC) at the more general ‘section’ level (1-digit level).

Gross domestic product (GDP)

National accounts data for the African countries have been provided by the African Union Commission. These have primarily been obtained from various national sources. Where necessary, official figures have been adjusted to conform to the System of National Accounts (SNA).

For European countries, annual national accounts are compiled in accordance with the European System of Accounts (ESA 2010); ESA is broadly consistent with the SNA as regards the definitions, accounting rules and classifications.

Mobile communication subscriptions

The number of mobile phone subscriptions per thousand inhabitants for EU countries gives the number of active mobile networks per thousand inhabitants. It includes both voice and data services, whether installed in mobile phones, tablets, notebooks or other devices.

Context

This article is based on the most recent edition of the ‘European Union and the African Union — A statistical portrait’ publication, prepared jointly by Eurostat and the Statistics Division of the African Union Commission.

Further statistics, covering all available African Union and European Union Member States, can be found in this publication. The first chapter gives an overview of demography and health, key economic indicators and external trade in Africa, Europe and some selected countries and world regions. Thematic chapters present key statistical indicators for demography, health, education, national accounts, economy and finance, industry and services and external economic relations.

The book has two tables for each indicator: one presenting data for the African countries and one for the European countries. Data for South Sudan were only available for a limited number of tables.

Africa-EU Strategic Partnership

The Joint Africa-EU Strategy (JAES), agreed in 2007, defines long-term policy orientations between the two continents, based on a shared vision and common principles. Within this framework, the African Union and the European Union work in partnership on a range of important issues as set out in the Joint roadmap 2014-17, which was adopted by African and EU Heads of State and Government during the 4th EU-Africa summit in April 2014.

The eighth College to College (C2C) meeting took place between the African Union Commission and the European Commission on 7 April 2016 in Addis Ababa and reaffirmed the aims of the Joint Africa-EU Strategy and of its five priority areas of the Joint Roadmap: 1. Peace and Security; 2. Democracy, Good Governance and Human Rights; 3. Human development; 4. Sustainable and inclusive development and growth and continental integration; and 5. Global and emerging issues.

Source link : https://ec.europa.eu/eurostat/statistics-explained/index.php/Africa-EU_-_key_statistical_indicators

Author :

Publish date : 2023-08-28 07:00:00

Copyright for syndicated content belongs to the linked Source.