In the wake of the Sudan conflict, fuel and arms smuggling spike in Chad and the broader Sahel.

Following months of simmering tensions, a power struggle between the leader of Sudan’s Transitional Military Council, General Abdel Fattah al-Burhan, and his deputy, General Mohamed Hamdan Dagalo, known as ‘Hemeti’, ignited a brutal conflict on 15 April 2023. The two rivals, leaders of the Sudanese Armed Forces (SAF) and Rapid Support Forces (RSF), respectively, locked in a struggle for dominance, are far from alone on the battlefield. A string of powerful allies from Libya, Egypt, Turkey, the United Arab Emirates, Saudi Arabia and Russia, among others, rally behind them, propping up their forces with diplomatic, financial and logistical support.

The economic, security and humanitarian fallout from Sudan’s conflict is reshaping illicit economies far beyond its porous borders, most notably in Chad and the broader Sahel region. While these illicit economies are not the focus of the current stalemate in Sudan, they are crucial components of the war economy feeding and sustaining the conflict. The crisis has already resulted in a surge in arms and fuel smuggling, and is also likely to boost demand for northbound human smuggling along established routes. This situation poses a significant threat to regional stability, providing armed groups with the resources to prolong the conflict and intensifying the security and economic challenges faced by vulnerable communities.

Illicit economies supplying the Sudanese conflict

Evidence indicates that two illicit markets that underpin Sudan’s war economy have surged since conflict broke out: arms trafficking and fuel smuggling. Despite the official closure of Chad’s border with Sudan in response to the conflict, smugglers in eastern Chad reported an uptick in cross-border fuel and arms smuggling from Chad and Libya into the conflict area.

The ongoing conflict has significantly disrupted regional fuel supply chains, which are key to sustaining the war, leading to noticeable shifts in the fuel smuggling market. Disruptions in Port Sudan’s operational capacity, which until the war was the main hub for fuel imports, and along key routes between Port Sudan and Khartoum, have reportedly led to increased reliance on imported fuel from Libya. While a significant amount of fuel is smuggled directly into Sudan through Libya’s south-eastern Kufra region, Chad has also served as a strategic corridor.

Chad’s role as a fuel smuggling transit hub first came to the fore as a result of the Chadian government’s two-month exemption of customs duties and taxes on fuel imports from Libya on 30 March 2023. This exemption, alongside a ban on fuel exports, sought to address the shortage of fuel in Chad, in large part a consequence of the closure of Chad’s only fuel refinery for maintenance.

Before the exemption, trucks carrying Libyan fuel were reportedly a rare sight, as duties and taxes were imposed by Chadian customs at the border. Subsidised Libyan fuel arriving in Chad was mostly transported by individual smugglers – often Chadian or Sudanese former fighters – in fuel drums on the back of pickup trucks using smuggling routes. This type of smuggling was mainly used to supply fuel to gold mining areas such as Kouri Bougoudi, where there is a concentration of illicit markets and armed criminal actors, but rarely beyond to the south of the country.

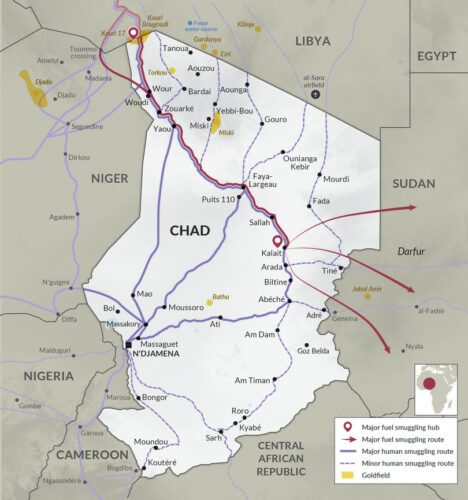

However, since April, and particularly since the outbreak of the conflict, the number of tanker trucks carrying fuel from Libya to northern Chad has reportedly seen a dramatic increase. Many of these tanker trucks reportedly transit Chad and are headed for Sudan, despite the export ban. Tankers enter Chad either directly via the Kouri Bougoudi area or via northern Niger. They then pass through several Chadian villages before entering Sudan, with a significant volume ending up both in eastern Chad and Darfur (see Figure 1).

It is estimated that in May around 15 tankers, transporting 36 000 litres of fuel each, transited weekly, often in convoys of three to five vehicles. As the tax exemption period has now ended (and should the Chadian government not reintroduce it), individual fuel smugglers are likely to respond to the demand for fuel as the war rages on.

The disruption to fuel supply chains caused by the Sudanese conflict has also provoked a sharp increase in fuel prices. Since Libyan fuel exports to Sudan increased in early May 2023, fuel prices in the black market of Um al-Aranib, in southern Libya, doubled from 1.5 Libyan dinars to 3 dinars per litre (approximately €0.3 to €0.6). Likewise, the cost of fuel in northern Chad, traditionally dependent on Libyan fuel, has surged. For instance, a 60-litre fuel drum in Zouar in northern Chad cost FCFA40 000 (€60) on 23 May, a substantial increase from the pre-May 2023 price range of FCFA27 500 to FCFA30 000 (€42–€46).

The increase in fuel prices has had significant impacts on the regional economy, and exacerbated economic hardship for locals in Chad, which continues to be one of the poorest countries in the world.

Figure 1 Fuel and human smuggling through Chad.

The escalating conflict has also stimulated illicit arms flows in the region. As of late May 2023, there has been a notable increase in arms smuggling to non-state armed groups directly tied to the war. Sudanese demand for weapons, driven primarily by civilians seeking protection, communities demanding retaliation and armed groups desiring to bolster their firepower, has surged. Demand may rise even further as civilians seek to protect themselves, encouraged by political figures such as Minni Minnawi, former rebel leader of the Sudanese Liberation Army and current governor of Darfur, who called on the people of Darfur ‘to take up arms to defend their property’.

The porous border between Sudan and Chad aids these flows, as do the activities of smuggling networks, predominantly composed of former Chadian and Sudanese fighters. Most of the weapons come from abandoned, stolen or illegally sold military stocks, and from other lingering conflicts in the region.

The risks posed by this surge in arms trafficking are considerable. Fleeing Sudanese fighters could seek refuge in Chad, contributing to the proliferation of weapons in the country. And these arms could end up in the hands of rebel groups seeking to overthrow the Chadian government and extend their regional influence, or criminal gangs aiming to dominate drug trafficking or other illicit activities. Weapons could also be used to commit violence against civilians and rival groups, and intensify intercommunity conflicts.

Conflict likely to drive sustained increase in human smuggling flows

Since the outbreak of the war in Sudan, 150 000 refugees have fled to Chad as of June 2023, predominantly from towns close to the Chadian border. Should the conflict endure, growing numbers of refugees moving into Chad from other parts of war-torn Sudan can be expected.

Displaced individuals are likely to initially settle in other Sahelian countries or in Libya, where there is an established Sudanese diaspora community, and this is likely to increase demand for northbound smuggling services to Libya. In the longer term, growing displacement from Sudan could also increase demand for sea crossings from Libya to Europe. Given that displaced people and those seeking asylum abroad might spend years in transit, the ripple effects of the current war in Sudan on migrant smuggling economies in Libya and the Sahel may only be felt in the coming years.

Long processing times for asylum applications processed in neighbouring states are likely to add pressure on local communities, and potentially exacerbate intercommunal conflicts in the medium term. In Niger for instance, tensions around Sudanese asylum seekers in Agadez are likely to escalate if there is a sustained inflow of new Sudanese refugees.

Newly displaced Sudanese refugees seeking to transit Chad are likely to swell demand for the services of the country’s human smuggling networks. Many networks are composed of Chadian fighters and ex-fighters, for whom people smuggling is a significant source of income.

Chad’s human smuggling economy predominantly facilitates movements from eastern to northern Chad and southern Libya, where economic opportunities, notably in gold mining, have attracted young Chadian and Sudanese men since the artisanal and small-scale gold mining boom that began in 2013. Networks are known to exploit vulnerable migrants, many of whom travel on credit to work in the goldfields of northern Chad and southern Libya. Their ‘debt’ is bought off the smugglers by gold-site owners for whom migrants are forced to work unpaid, often for undefined periods of time, until they have settled their debt. Sudanese refugees travelling on these routes would be vulnerable to such exploitative arrangements.

Conflict offers new resource streams for Chadian rebels: pawns with disruptive potential

As well as fuelling instability in the region’s illicit economies, the conflict in Sudan presents new opportunities for Chadian rebel fighters. These rebels are key participants in the Sahelian criminal markets and play a crucial role in maintaining the precarious balance of power across Sudan and Chad, and the broader Sahel region. The conflict could also threaten Chad’s tenuous peace with Sudan, which has held since a 2010 peace agreement ended a five-year conflict between the two governments and which saw each country financing rival rebel groups.

Since the October 2020 ceasefire agreement in Libya, Chadian fighters, who have been have engaged in mercenary work supporting several Libyan warring factions since 2011, have had fewer reasons to stay in Libya, and have turned elsewhere for income, including to Sahelian illicit economies. As chaos in Sudan unfolds, Chadian fighters, adept at finding new income streams, may well exploit the instability to find a new base in Sudan, drum up new demand for their services as mercenaries and profit from the war economy.

Figure 2 Prominent Chadian armed rebel groups, June 2023.

Chadian rebel groups are veterans of the region’s criminal economies, from drugs to arms, cars and people – both as traffickers and as their escorts. They also possess crucial knowledge of, and thus know how to manoeuvre within, the cross-border areas of Sudan, Chad, Libya and Niger.

Evidence from local sources already suggests that some Chadian fighters have headed to Khartoum from southern Libya. A convoy of around 15 vehicles, transporting 30 to 40 Chadian fighters, reportedly left Sebha in late April and travelled via Rebiana in Libya’s Kufra region before entering Sudan. The group reportedly joined the RSF in fighting against SAF forces in Khartoum. The key incentive for this move was reportedly the opportunity to access stolen vehicles, weapons and equipment, as well as the draw of criminal opportunity, such as the drug trafficking, fuel smuggling and arms trafficking markets.

Ripple effects

The second-tier impacts of Sudan’s conflict ripple far beyond its borders, reshaping regional illicit economies and threatening to further destabilize an already chronically fragile region. Illicit economies are the lifelines that sustain the operations of Chadian rebel groups, conflict actors in Sudan and numerous other armed groups across the region, contributing to broader instability. The surge in demand driven by the conflict for smuggled fuel and arms, the services of migrant smuggling networks – and possibly mercenary skills – is set to further empower, and enhance the resilience of, Chadian rebel groups, alongside other armed criminal networks operating in the region. In turn, illicit flows of fuel and arms are feeding into Sudan’s war economy, providing crucial supplies, and will most likely contribute to prolonging the conflict.

Notes

Source link : https://riskbulletins.globalinitiative.net/wea-obs-008/01-in-the-wake-of-the-sudan-conflict-fuel-and-arms-smuggling-spike.html

Author :

Publish date : 2023-08-08 07:00:00

Copyright for syndicated content belongs to the linked Source.